OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Moderators: MickeyDavis, paulpressey25

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Superfito

- Senior

- Posts: 679

- And1: 85

- Joined: Feb 02, 2006

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

I'm not a professional but I would hesitate to buy companies just cuz they're getting beaten up during this crazy event. Outside of core industries like airlines that are always going to get bailed out, this event feels more like it's accelerating inevitability than providing value plays for companies like Kohls that long-term were struggling anyways.

This return to normalcy concept feels miguided. The change is already done. Return to normalcy will not be return to the same.

This return to normalcy concept feels miguided. The change is already done. Return to normalcy will not be return to the same.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- HaroldinGMinor

- RealGM

- Posts: 15,934

- And1: 21,297

- Joined: Jan 23, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

I don't think we will hit bottom until the next couple of jobs/unemployment reports come out. I don't think that's totally baked into the markets just yet.

At a party given by a billionaire, Kurt Vonnegut informs Joseph Heller that their host had made more money in a single day than Heller had earned from his novel Catch-22.

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

midranger

- RealGM

- Posts: 40,065

- And1: 11,748

- Joined: May 12, 2002

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Anyone know anything about buying corporate paper? There are some steep bond discounts out there, even in companies that will almost certainly be bailed out if need be.

I’d rather be a bond holder than shareholder currently. At least you get something if the stock drops to zero.

I’d rather be a bond holder than shareholder currently. At least you get something if the stock drops to zero.

Please reconsider your animal consumption.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

HurricaneKid

- General Manager

- Posts: 8,093

- And1: 5,052

- Joined: Jul 13, 2010

- Location: Sconnie Nation

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

[quote = "midranger"]Anyone know anything about buying corporate paper? There are some steep bond discounts out there, even in companies that will almost certainly be bailed out if need be.

I’d rather be a bond holder than shareholder currently. At least you get something if the stock drops to zero.[/quote]

Bond rates are insanely low considering the inherent systematic risk now in place.

I'd say we are staring at a wildly nasty deflationary period with credit markets seizing and everyone's assets getting pummeled and incomes tanking. On the other hand, the fed just gave itself the ability to print money and buy trillions in corporate bonds to prop up markets. The threading of that needle is nearly impossible and I have no earthly idea what the world looks like in just a few short years.

I’d rather be a bond holder than shareholder currently. At least you get something if the stock drops to zero.[/quote]

Bond rates are insanely low considering the inherent systematic risk now in place.

I'd say we are staring at a wildly nasty deflationary period with credit markets seizing and everyone's assets getting pummeled and incomes tanking. On the other hand, the fed just gave itself the ability to print money and buy trillions in corporate bonds to prop up markets. The threading of that needle is nearly impossible and I have no earthly idea what the world looks like in just a few short years.

fishnc wrote:If I had a gun with two bullets and I was in a room with Hitler, Bin Laden, and LeBron, I would shoot LeBron twice.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- sidney lanier

- Head Coach

- Posts: 7,261

- And1: 10,505

- Joined: Feb 03, 2012

- Location: where late the sweet birds sang

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

HurricaneKid wrote:

Bond rates are insanely low considering the inherent systematic risk now in place.

I'd say we are staring at a wildly nasty deflationary period with credit markets seizing and everyone's assets getting pummeled and incomes tanking. On the other hand, the fed just gave itself the ability to print money and buy trillions in corporate bonds to prop up markets. The threading of that needle is nearly impossible and I have no earthly idea what the world looks like in just a few short years.

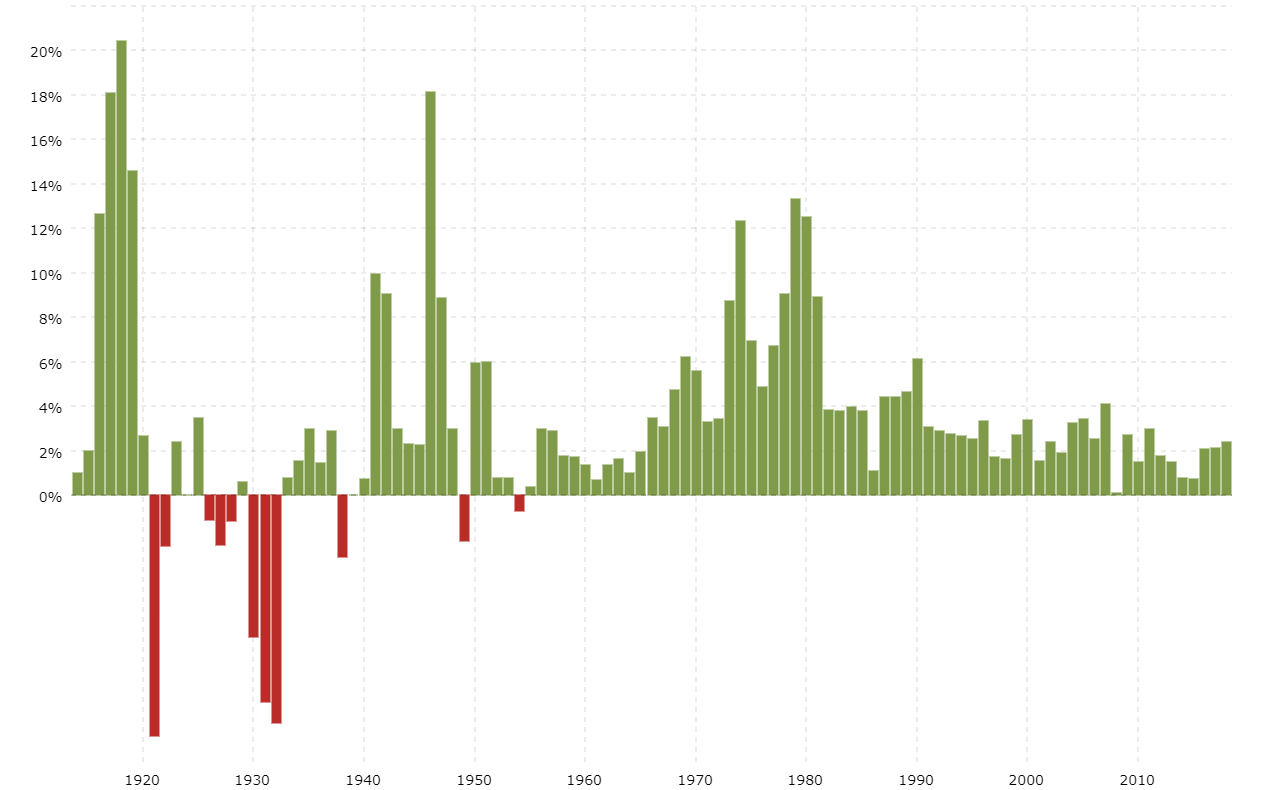

When you play with needles you run the risk of popping the balloon. If the Treasury pumps out Franklins as fast as it can, there is some point where they begin to be worth less (not worthless, worth less). We've lived the good life when it comes to inflation for so long that those under a certain age might not believe it really can exist, sort of like a predator in the woods the old folks warn about but the young folks have never seen.

HISTORICAL INFLATION RATE BY YEAR

Personally I think deflation is a greater risk right now, but you're right that danger lurks on both sides. In a recovery on steroids, which is what we are likely to see when this is all over, you're likely to have a new virus--inflation psychology--that spreads just as fast as the coronavirus. You saw it in the double-digit inflation years of the 1970s. What happens is prices go up and up, and the expectation of higher prices tomorrow pulls purchasing decisions forward to today, and inflation essentially gets stoked by itself.

We've never seen the kinds of distortions in the money supply we're about to see as we approach a quarter or a third of the work force on the sidelines, economic activity virtually shut down, and the Fed trying to compensate as fast as it can. I expect to see a zigzag course for a while.

"The Bucks in six always. That's for the culture." -- B. Jennings

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Ill-yasova

- RealGM

- Posts: 13,364

- And1: 2,562

- Joined: Jul 13, 2006

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

I think I'd actually like to invest in some of the cannabis companies out there because it seems like a bit of a no-brainer for growth in the future. I mean, this ship isn't going to get turned around any time soon and should just continue to see huge growth as it gets legalized in more states and receives more social acceptance. It's really just a matter of picking the right horse so I may spread out my purchases over a few of these companies. This is one company that looks really interesting to me right now:

https://finance.yahoo.com/news/aurora-cannabis-acb-strong-industry-134001482.html

Another interesting article:

https://finance.yahoo.com/news/3-cannabis-stocks-set-thrive-180514972.html

https://finance.yahoo.com/news/aurora-cannabis-acb-strong-industry-134001482.html

Another interesting article:

https://finance.yahoo.com/news/3-cannabis-stocks-set-thrive-180514972.html

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- M-C-G

- RealGM

- Posts: 23,531

- And1: 9,861

- Joined: Jan 13, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Ill-yasova wrote:I think I'd actually like to invest in some of the cannabis companies out there because it seems like a bit of a no-brainer for growth in the future. I mean, this ship isn't going to get turned around any time soon and should just continue to see huge growth as it gets legalized in more states and receives more social acceptance. It's really just a matter of picking the right horse so I may spread out my purchases over a few of these companies. This is one company that looks really interesting to me right now:

https://finance.yahoo.com/news/aurora-cannabis-acb-strong-industry-134001482.html

Another interesting article:

https://finance.yahoo.com/news/3-cannabis-stocks-set-thrive-180514972.html

I have a lot invested in cannabis, and at one point was riding high (pun intended). CGC dropping Linton was a major mistake for the entire industry, because Canopy was kind of the barometer for all the rest. That said, I have averaged down on CGC and when I saw Aurora trading for .80 I bought a lot of shares. Sure they are going to carry negative EPS for a while, but my goodness, that was such a low entry point for such a big (future) industry. Actually sold off some other investments to load up. I suppose the risk is they don't have the assets to weather this storm, but when I read articles about people loading up on weed for quarentine, it leads me to believe this could be a stellar quarter despite the weirdness of the world. Even if it rebounds to 5, there is a ton of money to be made, strange times!

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- M-C-G

- RealGM

- Posts: 23,531

- And1: 9,861

- Joined: Jan 13, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

I have been patiently waiting on airlines, I think there is another major drop, probably around the time the next earnings calls are up, but if I can get into United at something like 12-15 a share, that seems like there is a lot of money to be made, when things normalize.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- BucksFanSD

- Veteran

- Posts: 2,887

- And1: 1,516

- Joined: Jun 28, 2012

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Warren Buffet sold Delta and Southwest shares last week, this coming about two weeks after stating he would not sell his airlines shares.

This news was released after Friday's close, and the after hours trading on Friday showed that airline stocks may open tomorrow with a drop based on Buffet's sell off.

Also, I thought this analyst's take below was interesting.

https://www.tiktok.com/@acouplecents/video/6812045326409600261?u_code=d694cj7jj0bb56&preview_pb=0&language=en×tamp=1586065966&user_id=6692724574141826053&utm_campaign=client_share&app=musically&utm_medium=ios&user_id=6692724574141826053&tt_from=copy&utm_source=copy&source=h5_m

This news was released after Friday's close, and the after hours trading on Friday showed that airline stocks may open tomorrow with a drop based on Buffet's sell off.

Also, I thought this analyst's take below was interesting.

https://www.tiktok.com/@acouplecents/video/6812045326409600261?u_code=d694cj7jj0bb56&preview_pb=0&language=en×tamp=1586065966&user_id=6692724574141826053&utm_campaign=client_share&app=musically&utm_medium=ios&user_id=6692724574141826053&tt_from=copy&utm_source=copy&source=h5_m

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- MartyConlonOnTheRun

- RealGM

- Posts: 28,114

- And1: 13,742

- Joined: Jun 27, 2006

- Location: Section 212 - Raising havoc in Squad 6

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

DigitalFool wrote:Took a new position in KSS. It'll either recover or go bankrupt, but I expect the former unless this stay at home order lasts more than 9 months.

Sell, Sell, Sell

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- BucksFanSD

- Veteran

- Posts: 2,887

- And1: 1,516

- Joined: Jun 28, 2012

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

MartyConlonOnTheRun wrote:DigitalFool wrote:Took a new position in KSS. It'll either recover or go bankrupt, but I expect the former unless this stay at home order lasts more than 9 months.

Sell, Sell, Sell

I bought KSS Friday and sold today

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- DigitalFool

- Veteran

- Posts: 2,611

- And1: 166

- Joined: Jul 13, 2006

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

BucksFanSD wrote:MartyConlonOnTheRun wrote:DigitalFool wrote:Took a new position in KSS. It'll either recover or go bankrupt, but I expect the former unless this stay at home order lasts more than 9 months.

Sell, Sell, Sell

I bought KSS Friday and sold today

Going to let it ride!

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- jschligs

- General Manager

- Posts: 9,232

- And1: 7,200

- Joined: Jul 20, 2016

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

I'm in the position now where my longs will be long, and I'm riding my options until they expire because selling now would be idiotic.

There is no way we can have hit bottom already, like, it's not possible.

There is no way we can have hit bottom already, like, it's not possible.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Stannis

- RealGM

- Posts: 19,594

- And1: 13,003

- Joined: Dec 05, 2011

- Location: Game 1, 2025 ECF

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Well my new positions (ULTA, SYY, HASI) are already up 20% from buying last week lol. IDXX up like 50% from two weeks ago.

My plan was to DCA. But didn't expect such a big bounce so soon. Are we set to fall again just as fast? Who really knows lol.

My plan was to DCA. But didn't expect such a big bounce so soon. Are we set to fall again just as fast? Who really knows lol.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

Ruzious

- Retired Mod

- Posts: 47,909

- And1: 11,582

- Joined: Jul 17, 2001

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Stannis wrote:Well my new positions (ULTA, SYY, HASI) are already up 20% from buying last week lol. IDXX up like 50% from two weeks ago.

My plan was to DCA. But didn't expect such a big bounce so soon. Are we set to fall again just as fast? Who really knows lol.

Yeah, I think we are set to fall - maybe not tomorrow, but like jschligs said - "There is no way we can have hit bottom already, like, it's not possible."

A good strategy (imo) when you make a quick hit like that is to sell half. So even if it keeps going up, you still benefit. And if it goes down, you took your profit.

"A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools." - Douglas Adams

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

midranger

- RealGM

- Posts: 40,065

- And1: 11,748

- Joined: May 12, 2002

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Ruzious wrote:Stannis wrote:Well my new positions (ULTA, SYY, HASI) are already up 20% from buying last week lol. IDXX up like 50% from two weeks ago.

My plan was to DCA. But didn't expect such a big bounce so soon. Are we set to fall again just as fast? Who really knows lol.

Yeah, I think we are set to fall - maybe not tomorrow, but like jschligs said - "There is no way we can have hit bottom already, like, it's not possible."

A good strategy (imo) when you make a quick hit like that is to sell half. So even if it keeps going up, you still benefit. And if it goes down, you took your profit.

Good strategy.

Just beware the tax implications. Short term capital gains can be a bitch.

Please reconsider your animal consumption.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- M-C-G

- RealGM

- Posts: 23,531

- And1: 9,861

- Joined: Jan 13, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

My not so knowledgeable take on the airlines, I think they are going to have a rough time coming up. United has an earnings call mid April, and I suspect there will considerable fallout going forward while people aren't really traveling. I think something under 10 dollars might happen and if so, I'll be buying.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Stannis

- RealGM

- Posts: 19,594

- And1: 13,003

- Joined: Dec 05, 2011

- Location: Game 1, 2025 ECF

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

M-C-G wrote:My not so knowledgeable take on the airlines, I think they are going to have a rough time coming up. United has an earnings call mid April, and I suspect there will considerable fallout going forward while people aren't really traveling. I think something under 10 dollars might happen and if so, I'll be buying.

If anybody has experience... What usually happens to a stock when they get a bailout?

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Stannis

- RealGM

- Posts: 19,594

- And1: 13,003

- Joined: Dec 05, 2011

- Location: Game 1, 2025 ECF

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Market about to have another hot opening. I think people are feeling more comfortable with how China, Italy etc have declining death rates. It was a 10 year bull run, so I would think people have saved a great deal of money and are putting it back into the market after the dips.

However... social distancing is going to eventually put us in a recession. Unless we can supply everyone with n95 masks, make a law where everyone has to wear a masks when we step out of our homes and everyone can do what they used to do. Otherwise, more non-essential businesses will be closing and more people will continue to lose their jobs.

We as a country really haven't felt a financial impact yet imo. Or we aren't realizing it yet. Once people burn through their savings is when things will get really scary for the market.

However... social distancing is going to eventually put us in a recession. Unless we can supply everyone with n95 masks, make a law where everyone has to wear a masks when we step out of our homes and everyone can do what they used to do. Otherwise, more non-essential businesses will be closing and more people will continue to lose their jobs.

We as a country really haven't felt a financial impact yet imo. Or we aren't realizing it yet. Once people burn through their savings is when things will get really scary for the market.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- MartyConlonOnTheRun

- RealGM

- Posts: 28,114

- And1: 13,742

- Joined: Jun 27, 2006

- Location: Section 212 - Raising havoc in Squad 6

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Stannis wrote:Market about to have another hot opening. I think people are feeling more comfortable with how China, Italy etc have declining death rates. It was a 10 year bull run, so I would think people have saved a great deal of money and are putting it back into the market after the dips.

However... social distancing is going to eventually put us in a recession. Unless we can supply everyone with n95 masks, make a law where everyone has to wear a masks when we step out of our homes and everyone can do what they used to do. Otherwise, more non-essential businesses will be closing and more people will continue to lose their jobs.

We as a country really haven't felt a financial impact yet imo. Or we aren't realizing it yet. Once people burn through their savings is when things will get really scary for the market.

Unfortunately, I think there is a lag to the layoffs/'voluntary' salary cuts. A lot of people think they are safe and living normally but there are down stream effects that take longer. There are a lot of discussions going on how and what to cut.