OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Moderators: MickeyDavis, paulpressey25

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- HaroldinGMinor

- RealGM

- Posts: 15,797

- And1: 21,103

- Joined: Jan 23, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

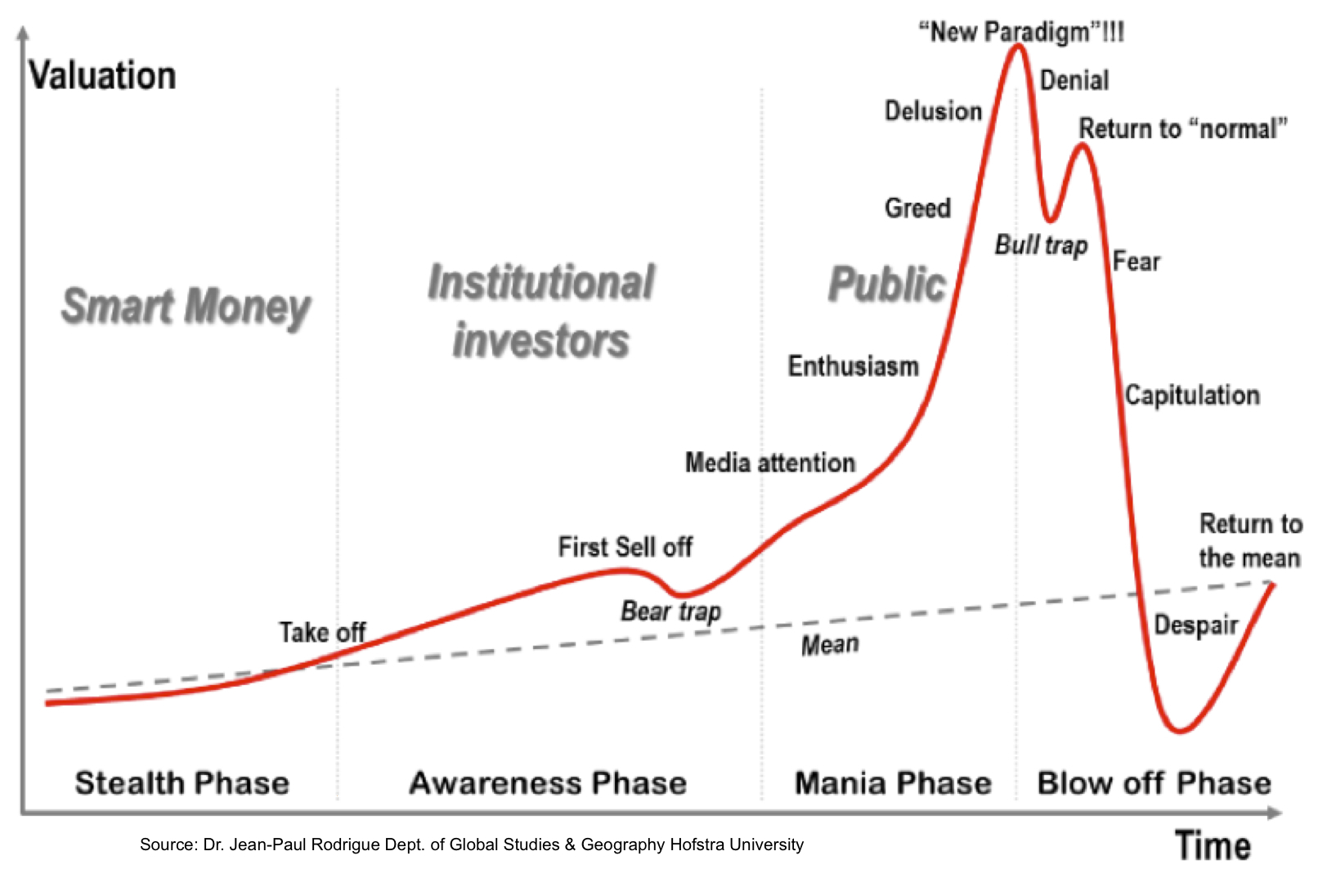

How does that compare to the stock market run up the last year? Are we in the delusion phase?

At a party given by a billionaire, Kurt Vonnegut informs Joseph Heller that their host had made more money in a single day than Heller had earned from his novel Catch-22.

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- M-C-G

- RealGM

- Posts: 23,523

- And1: 9,849

- Joined: Jan 13, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

engelmartin wrote:midranger wrote:

Here is a curve created in 2008 by Dr Jean-Paul Rodrigue of Hostra University to describe market bubbles.

I'll let everyone compare it to the graph of the cryptocurrency of their choice (notably Bitcoin) and reach their own deductions on what will happen next.

So if we are currently at "Bull trap", it's a good time to buy in as long as we sell when it returns to normal?

More importantly, where are we at in this cycle as Bucks fans? I feel like despair needs to be quite a bit deeper

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

midranger

- RealGM

- Posts: 39,816

- And1: 11,552

- Joined: May 12, 2002

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

HaroldinGMinor wrote:How does that compare to the stock market run up the last year? Are we in the delusion phase?

No doubt the stock market IS going to correct, perhaps painfully. It will recover and go up again.

With the tax law, I think a year of bull run is likely. I probably wouldn't put all my money in at 27k or something. Rebalance into bonds and international.

Please reconsider your animal consumption.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

midranger

- RealGM

- Posts: 39,816

- And1: 11,552

- Joined: May 12, 2002

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

M-C-G wrote:engelmartin wrote:midranger wrote:

Here is a curve created in 2008 by Dr Jean-Paul Rodrigue of Hostra University to describe market bubbles.

I'll let everyone compare it to the graph of the cryptocurrency of their choice (notably Bitcoin) and reach their own deductions on what will happen next.

So if we are currently at "Bull trap", it's a good time to buy in as long as we sell when it returns to normal?

More importantly, where are we at in this cycle as Bucks fans? I feel like despair needs to be quite a bit deeper

I think if the "mean" curve was exactly flat, we would be nearing return to the mean.

Three words. Same. Old. Bucks.

Please reconsider your animal consumption.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

gbmb34

- Pro Prospect

- Posts: 879

- And1: 96

- Joined: Dec 01, 2009

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

bizarro wrote:Crypto gents,

I've done my market research for the past week and I want to share with you my thoughts:

(1) BTC appears headed back for an upswing. It has held its 50 day averages and the market has today revealed it is most likely headed back North.

(2) If you aren't holding an Alt Coin for long-term now is your time to consider converting or putting aside.

(3) The whales have won and they've garnered their profits and the wave is going to come crashing

(4) The absurd run-up we experienced this past week (and, it was abusrd - and, glorious) is headed toward correction from my vantage point.

(5) I've sold all my Ripple and converted to BTC because I am fearing a massive correction. I should add: I don't hold for nostalgic purposes. I read the market. I still see XRP as a potential player in the next few years. I'm not that emotionally invested in the coin. I don't like the Korean influence here. And this is the 2nd correction in a couple weeks. I don't trust it like I trust a legacy like BTC. I am going to off-set the losses for the time being. Take this or leave it.

(6) Cardano investors: my new research today has me seeing a dip correcting into the mid $0.50's USD. If that is the case, and I think it is, this new correction would be a perfect time to re-up. I continue to be convinced this is a massively upside laden long-term project. This is a 3 year game. I am buying back in at that expected time.

(7) I personally don't see Ethereum continuing its climb. I see it correcting. It's what markets do. These run-ups. These run-ups. They're a fools game. I am personally seeing another correction as it simply has absolutely no support at its current levels. I'm seeing maybe 7,000,000 satoshis as its next plateau (circa $1,015 - 1,020 USD).

That's what I got. Take it for what it is: my own personal opinions and research.

Best of luck!

If you had a few grand to throw at a few things, what would you recommend? This isn't life savings by any means just hoping to invest (or gamble midranger

packerbreakdown.wordpress.com

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

midranger

- RealGM

- Posts: 39,816

- And1: 11,552

- Joined: May 12, 2002

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

FWIW, my belief is if you keep your "mad money" for alternative investments to 5% or less of total portofolio, knock yourself out.

Everyone has differing interests and those can/should? be explored financially as you see fit.

Everyone has differing interests and those can/should? be explored financially as you see fit.

Please reconsider your animal consumption.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- jmart762

- Pro Prospect

- Posts: 933

- And1: 430

- Joined: Jul 01, 2010

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Bizarro, or anyone here, have you read any Derrick Jensen, Daniel Quinn or similar authors? If so, what do you think of the ideas and how do you extrapolate that means for planning and investing? I'm in my 20's and I'm self-employed as a farmer and marketer, and I finally have my business profitable, and I'm looking into investing and saving for a future home build, but I'm also dubious of the future of our economical system, which this crypto talk complicates further. I see a decent amount of alluding to, even in this thread, about resource depletion and energy usage.

So I wonder, rather than investing in traditional options which depend on the global industrial system which will face giant problems in the next half century of climate change, desertification, biodiversity collapse, debt, etc, or should I invest in more tangible, and independent options? Things like land, and even further- tree plantings, water collection, etc. Less ROI, but potentially more "real". Or a happy medium with something like http://www.propagateventures.com? I already have a decent amount in my retirement, but it's a conundrum and causes me angst.

***Maybe OT, but I'd also be happy to discuss outside of this about the merits of solar, wind, and other "renewable" resources and if they are really a viable solution or not. I'm intrigued because I saw Bizarro mention that as a benefit of cryptocurrencies. I would venture to say that the energy economy will need to go in my lifetime, regardless if it's powered by fossil fuels or "renewables".

So I wonder, rather than investing in traditional options which depend on the global industrial system which will face giant problems in the next half century of climate change, desertification, biodiversity collapse, debt, etc, or should I invest in more tangible, and independent options? Things like land, and even further- tree plantings, water collection, etc. Less ROI, but potentially more "real". Or a happy medium with something like http://www.propagateventures.com? I already have a decent amount in my retirement, but it's a conundrum and causes me angst.

***Maybe OT, but I'd also be happy to discuss outside of this about the merits of solar, wind, and other "renewable" resources and if they are really a viable solution or not. I'm intrigued because I saw Bizarro mention that as a benefit of cryptocurrencies. I would venture to say that the energy economy will need to go in my lifetime, regardless if it's powered by fossil fuels or "renewables".

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

bizarro

- RealGM

- Posts: 14,778

- And1: 7,290

- Joined: Jul 13, 2005

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

gbmb34 wrote:bizarro wrote:Crypto gents,

I've done my market research for the past week and I want to share with you my thoughts:

(1) BTC appears headed back for an upswing. It has held its 50 day averages and the market has today revealed it is most likely headed back North.

(2) If you aren't holding an Alt Coin for long-term now is your time to consider converting or putting aside.

(3) The whales have won and they've garnered their profits and the wave is going to come crashing

(4) The absurd run-up we experienced this past week (and, it was abusrd - and, glorious) is headed toward correction from my vantage point.

(5) I've sold all my Ripple and converted to BTC because I am fearing a massive correction. I should add: I don't hold for nostalgic purposes. I read the market. I still see XRP as a potential player in the next few years. I'm not that emotionally invested in the coin. I don't like the Korean influence here. And this is the 2nd correction in a couple weeks. I don't trust it like I trust a legacy like BTC. I am going to off-set the losses for the time being. Take this or leave it.

(6) Cardano investors: my new research today has me seeing a dip correcting into the mid $0.50's USD. If that is the case, and I think it is, this new correction would be a perfect time to re-up. I continue to be convinced this is a massively upside laden long-term project. This is a 3 year game. I am buying back in at that expected time.

(7) I personally don't see Ethereum continuing its climb. I see it correcting. It's what markets do. These run-ups. These run-ups. They're a fools game. I am personally seeing another correction as it simply has absolutely no support at its current levels. I'm seeing maybe 7,000,000 satoshis as its next plateau (circa $1,015 - 1,020 USD).

That's what I got. Take it for what it is: my own personal opinions and research.

Best of luck!

If you had a few grand to throw at a few things, what would you recommend? This isn't life savings by any means just hoping to invest (or gamble midranger) in a few things with some nice upside.

Well, this entirely depends on your age and your risk profile.

If you are looking for a 'secure' long-play more conservative investment: Bitcoin, Ethereum, Litecoin, Dash, Bitcoin Cash, and Ethereum Classic

If you're looking at a lower-entry but still solid long-play set of prospects: Cardano, Monero, Neo, Iota - off the top of my head

If you're looking for a boom/bust potential high reward: The Alt Coin market - buyer beware: there is lots of volatility here. I absolutelyy adhere to the moving averages and a 50/50 strategy with all my investments here. To this end, I rarely lose a single cent here and sometimes make a lot of cents. But my point is: I always pay myself back no matter what I purchase. The moment it's buying price doubles, I convert to fiat and/or convert to BTC as the legacy standard. Case and point: today I cashed out 1/2 of my Q Link, Deep Brain Chain, and Substratum even though I am a firm believer in their upside beyond this dip. Why? Because, I principally will not lose the money I invested into the coins. I sold these into Bitcoin because I see a market correction in its three resistance plateaus versus the 50 day average and anticipate it 'should' rise again shortly. Will it? I can't say. But, I do think it's a matter of time. At that point, I will rinse and repeat: my payback will have earned interest and will hold new value.

BUT, don't listen to me. Listen to yourself. Articulate your goals. Learn to read the market if you so desire. One can obviously make more money in the lower priced coins at a faster rate but that money can be lost just as quickly. Most coins are not the Ethereums, Bitcoins, or Neos of the world. Lots and lots of BS ICO's and coins. Lots of swing traders pumping and dumping creating artificial value. If you go the route of the 'Top 10', for instance, you don't have to worry about this as much. My two cents. Best of luck.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

midranger

- RealGM

- Posts: 39,816

- And1: 11,552

- Joined: May 12, 2002

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

If you can keep bees alive and happy and pollinating, you'll make a ton in the next decade or two. Our food chain will eventually depend on it.

Please reconsider your animal consumption.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- MickeyDavis

- Global Mod

- Posts: 104,682

- And1: 56,849

- Joined: May 02, 2002

- Location: The Craps Table

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Selling to get back my original investment is something I almost always do no matter the investment. I hate losing money on anything. I do the same thing at the craps table. When I'm ahead a certain point I will never walk away a loser, the original chips are in my pocket. But I don't agree with the term "playing with house money". Once I win it it's MY money.

On the flip side you have to know when to cut your losses. If something goes down I re-examine and if the reasons I bought are still valid I will either hold or add to the position. Otherwise I sell and get out. And of course sometimes I add more and it keeps going down. It happens.

On the flip side you have to know when to cut your losses. If something goes down I re-examine and if the reasons I bought are still valid I will either hold or add to the position. Otherwise I sell and get out. And of course sometimes I add more and it keeps going down. It happens.

I'm against picketing but I don't know how to show it.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

bizarro

- RealGM

- Posts: 14,778

- And1: 7,290

- Joined: Jul 13, 2005

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

jmart762 wrote:Bizarro, or anyone here, have you read any Derrick Jensen, Daniel Quinn or similar authors? If so, what do you think of the ideas and how do you extrapolate that means for planning and investing? I'm in my 20's and I'm self-employed as a farmer and marketer, and I finally have my business profitable, and I'm looking into investing and saving for a future home build, but I'm also dubious of the future of our economical system, which this crypto talk complicates further. I see a decent amount of alluding to, even in this thread, about resource depletion and energy usage.

So I wonder, rather than investing in traditional options which depend on the global industrial system which will face giant problems in the next half century of climate change, desertification, biodiversity collapse, debt, etc, or should I invest in more tangible, and independent options? Things like land, and even further- tree plantings, water collection, etc. Less ROI, but potentially more "real". Or a happy medium with something like http://www.propagateventures.com? I already have a decent amount in my retirement, but it's a conundrum and causes me angst.

***Maybe OT, but I'd also be happy to discuss outside of this about the merits of solar, wind, and other "renewable" resources and if they are really a viable solution or not. I'm intrigued because I saw Bizarro mention that as a benefit of cryptocurrencies. I would venture to say that the energy economy will need to go in my lifetime, regardless if it's powered by fossil fuels or "renewables".

This is a loaded piece! Why don't you PM me here and we can talk at length about a great many things. Too many roads to diverge into on the Investment thread.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- AussieBuck

- RealGM

- Posts: 42,345

- And1: 20,856

- Joined: May 10, 2006

- Location: Bucks in 7?

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Renewable energy is way further along than most people realise.

Sent from my [device_name] using [url]RealGM mobile app[/url]

Sent from my [device_name] using [url]RealGM mobile app[/url]

emunney wrote:

We need a man shaped like a chicken nugget with the shot selection of a 21st birthday party.

GHOSTofSIKMA wrote:

if you combined jabari parker, royal ivey, a shrimp and a ball sack youd have javon carter

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- AussieBuck

- RealGM

- Posts: 42,345

- And1: 20,856

- Joined: May 10, 2006

- Location: Bucks in 7?

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Thoughts on Verge (xvg)? I put some money into it as Wraith protocol seemed like a good development but it seems to have stalled in value despite the release.

Sent from my [device_name] using [url]RealGM mobile app[/url]

Sent from my [device_name] using [url]RealGM mobile app[/url]

emunney wrote:

We need a man shaped like a chicken nugget with the shot selection of a 21st birthday party.

GHOSTofSIKMA wrote:

if you combined jabari parker, royal ivey, a shrimp and a ball sack youd have javon carter

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

skones

- RealGM

- Posts: 37,108

- And1: 17,267

- Joined: Jul 20, 2004

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

AussieBuck wrote:Thoughts on Verge (xvg)? I put some money into it as Wraith protocol seemed like a good development but it seems to have stalled in value despite the release.

Sent from my [device_name] using [url]RealGM mobile app[/url]

Perhaps take a look at the rest of the market for your clue as to why.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- AussieBuck

- RealGM

- Posts: 42,345

- And1: 20,856

- Joined: May 10, 2006

- Location: Bucks in 7?

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Yeah I'm a noob but not that nooby

Sent from my [device_name] using [url]RealGM mobile app[/url]

Sent from my [device_name] using [url]RealGM mobile app[/url]

emunney wrote:

We need a man shaped like a chicken nugget with the shot selection of a 21st birthday party.

GHOSTofSIKMA wrote:

if you combined jabari parker, royal ivey, a shrimp and a ball sack youd have javon carter

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

bizarro

- RealGM

- Posts: 14,778

- And1: 7,290

- Joined: Jul 13, 2005

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

AussieBuck wrote:Thoughts on Verge (xvg)? I put some money into it as Wraith protocol seemed like a good development but it seems to have stalled in value despite the release.

Sent from my [device_name] using [url]RealGM mobile app[/url]

Verge is definitely experiencing the pangs of the wraith protocol release (i believe Windows only Full presently) completely at the tip of a major market correction. Verge also seems to be the recipient of quite a bit of animosity from within the market - I don't quite understand this but significant amount of FUD and dumping happened on the release of the news in cahoots with the general market correction. I've seen several indicators (as well as word from a market analyst I really trust) that Verge, though may take some time longer than some anticipated, has the ability to hit a $0.70 mark and then a final year-end (2018) correction at the $1.70 mark. Take that fwiw: an opinion. Needless to say, I continue to mine Verge today - even with modest returns (and, honestly mostly due to the fact my profit-switching features are down HA!( - and feel fine doing so.

Re: RE: Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- AussieBuck

- RealGM

- Posts: 42,345

- And1: 20,856

- Joined: May 10, 2006

- Location: Bucks in 7?

-

Re: RE: Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

It's absolutely been attacked, tonnes of strategic fake news spread at points where it was gaining traction and during high volume periods lots of action attacking attempted price surges. I took this as it being a threat to bigger players but I dunno, I'm rapidly playing catch-up in this space. Fortunately my other holds are VEN and BAT and they seem to be riding a much less rocky road.bizarro wrote:AussieBuck wrote:Thoughts on Verge (xvg)? I put some money into it as Wraith protocol seemed like a good development but it seems to have stalled in value despite the release.

Sent from my [device_name] using [url]RealGM mobile app[/url]

Verge is definitely experiencing the pangs of the wraith protocol release (i believe Windows only Full presently) completely at the tip of a major market correction. Verge also seems to be the recipient of quite a bit of animosity from within the market - I don't quite understand this but significant amount of FUD and dumping happened on the release of the news in cahoots with the general market correction. I've seen several indicators (as well as word from a market analyst I really trust) that Verge, though may take some time longer than some anticipated, has the ability to hit a $0.70 mark and then a final year-end (2018) correction at the $1.70 mark. Take that fwiw: an opinion. Needless to say, I continue to mine Verge today - even with modest returns (and, honestly mostly due to the fact my profit-switching features are down HA!( - and feel fine doing so.

Thanks for the input dude I'll be sure to lean on you more

Sent from my [device_name] using [url]RealGM mobile app[/url]

emunney wrote:

We need a man shaped like a chicken nugget with the shot selection of a 21st birthday party.

GHOSTofSIKMA wrote:

if you combined jabari parker, royal ivey, a shrimp and a ball sack youd have javon carter

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

midranger

- RealGM

- Posts: 39,816

- And1: 11,552

- Joined: May 12, 2002

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Anyone ever participate on the peer to peer lending or crowd funded real estate websites?

Please reconsider your animal consumption.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

bizarro

- RealGM

- Posts: 14,778

- And1: 7,290

- Joined: Jul 13, 2005

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

midranger wrote:Anyone ever participate on the peer to peer lending or crowd funded real estate websites?

No, but before I dove so deep in crypto I was seriously considering. I'd be curious to hear anyone's experience. It seems like an interesting idea.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

bizarro

- RealGM

- Posts: 14,778

- And1: 7,290

- Joined: Jul 13, 2005

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Speaking of Crypto: After the S Korean announcement (to be expected) today, the market has experienced a major upswing after the much needed correction. Such a fascinating marketplace.