Political Roundtable Part XXIV

Moderators: nate33, montestewart, LyricalRico

Re: Political Roundtable Part XXIV

-

stilldropin20

- RealGM

- Posts: 11,370

- And1: 1,233

- Joined: Jul 31, 2002

-

Re: Political Roundtable Part XXIV

just put a universal price tag on each crime. government comes in and confiscates wealth (of the entire family if necessary) to pay victims.

so if mom and dad raise an axe murderer mom and dad house gets taken away and mom and dad can also end up in prison paying for their born bred and raised axe murderer's crimes.

take money away from school systems and local police whence the axe murder grew up. take money away from the kids friends. etc etc. make them all pay.

if it takes a village to raise a child it certainly takes a village to raise an axe murderer. make em pay for it!

so if mom and dad raise an axe murderer mom and dad house gets taken away and mom and dad can also end up in prison paying for their born bred and raised axe murderer's crimes.

take money away from school systems and local police whence the axe murder grew up. take money away from the kids friends. etc etc. make them all pay.

if it takes a village to raise a child it certainly takes a village to raise an axe murderer. make em pay for it!

like i said, its a full rebuild.

Re: Political Roundtable Part XXIV

-

Zonkerbl

- Retired Mod

- Posts: 9,330

- And1: 4,915

- Joined: Mar 24, 2010

-

Re: Political Roundtable Part XXIV

I'm talking about taking money from foreign lobbyists and making it look like they're US citizens, like the NRA did and Trump did during his inauguration. I'm talking about defrauding US taxpayers out of hundreds of millions of dollars of tax revenue by creatively revaluing your real estate assets. Setting up fraudulent online universities and getting away with it scott free. Creating charities to avoid paying taxes and then using it as your personal piggy bank. Creating a culture of corruption, where billionaires think laws are only for the little people to abide by. Putting the US government up to the highest bidder. Utterly destroying Democracy in favor of Plutocracy.

Ax murderers, JFC. Who gives a ****?

Ax murderers, JFC. Who gives a ****?

I've been taught all my life to value service to the weak and powerless.

Re: Political Roundtable Part XXIV

- FAH1223

- RealGM

- Posts: 16,485

- And1: 7,579

- Joined: Nov 01, 2005

- Location: Laurel, MD

-

Re: Political Roundtable Part XXIV

-

Zonkerbl

- Retired Mod

- Posts: 9,330

- And1: 4,915

- Joined: Mar 24, 2010

-

Re: Political Roundtable Part XXIV

Well see 2% looks like less than 70%

I've been taught all my life to value service to the weak and powerless.

Re: Political Roundtable Part XXIV

-

dckingsfan

- RealGM

- Posts: 36,025

- And1: 21,166

- Joined: May 28, 2010

Re: Political Roundtable Part XXIV

Pretty sure individuals don't really understand what either the higher marginal rates or wealth taxes actually mean. They are just reacting to the demagoguing of the rich.

It seems like the winning strategy in the next election is to:

1) Run against Trump

2) Run against the wealthy

3) Ignore the state of the federal government finances

It seems like the winning strategy in the next election is to:

1) Run against Trump

2) Run against the wealthy

3) Ignore the state of the federal government finances

Re: Political Roundtable Part XXIV

-

Zonkerbl

- Retired Mod

- Posts: 9,330

- And1: 4,915

- Joined: Mar 24, 2010

-

Re: Political Roundtable Part XXIV

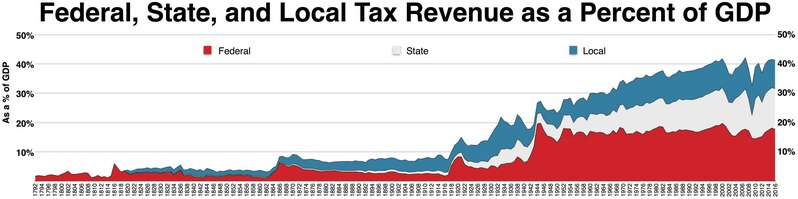

Let's talk about taxes as a share of GDP

https://www.oecd.org/tax/tax-policy/revenue-statistics-highlights-brochure.pdf

This statistic includes central, state, and local revenue. The united states, in 2017, had a revenue to GDP ratio of 27.1%. The OECD average was 34.2%.

So not only does the United States have criminally unequal income and wealth distributions, it also does not come close to collecting enough revenue to provide services expected of a developed country.

The billionaires have done a good job, until Trump came along, of hiding how much damage they are doing to the fabric of democracy by undermining the institutions that normally prevent citizens of developed countries from descending into poverty. Namely, healthcare and access to higher education. It is historically logical and *inevitable* that the party that does not explicitly represent the plutocrats must make forcing the wealthy to contribute their fair share - which clearly they are *not* - one of their primary platforms.

If you dig into table 1 a little you can see that even before the $1.5 trillion tax giveaway to the wealthy occurred, the US was getting a lot of revenue from income taxes and relatively little revenue from corporate income taxes. Interestingly, we get a rather high percent of our revenue from property taxes, because of our state and county level property taxes, which is apparently not such a big thing in other countries. Other countries also have a VAT, but I guess that's a different conversation.

https://www.oecd.org/tax/tax-policy/revenue-statistics-highlights-brochure.pdf

This statistic includes central, state, and local revenue. The united states, in 2017, had a revenue to GDP ratio of 27.1%. The OECD average was 34.2%.

So not only does the United States have criminally unequal income and wealth distributions, it also does not come close to collecting enough revenue to provide services expected of a developed country.

The billionaires have done a good job, until Trump came along, of hiding how much damage they are doing to the fabric of democracy by undermining the institutions that normally prevent citizens of developed countries from descending into poverty. Namely, healthcare and access to higher education. It is historically logical and *inevitable* that the party that does not explicitly represent the plutocrats must make forcing the wealthy to contribute their fair share - which clearly they are *not* - one of their primary platforms.

If you dig into table 1 a little you can see that even before the $1.5 trillion tax giveaway to the wealthy occurred, the US was getting a lot of revenue from income taxes and relatively little revenue from corporate income taxes. Interestingly, we get a rather high percent of our revenue from property taxes, because of our state and county level property taxes, which is apparently not such a big thing in other countries. Other countries also have a VAT, but I guess that's a different conversation.

I've been taught all my life to value service to the weak and powerless.

Re: Political Roundtable Part XXIV

-

Wizardspride

- RealGM

- Posts: 17,681

- And1: 11,822

- Joined: Nov 05, 2004

- Location: Olney, MD/Kailua/Kaneohe, HI

-

Re: Political Roundtable Part XXIV

?s=19

President Donald Trump referred to African countries, Haiti and El Salvador as "shithole" nations during a meeting Thursday and asked why the U.S. can't have more immigrants from Norway.

Re: Political Roundtable Part XXIV

-

Zonkerbl

- Retired Mod

- Posts: 9,330

- And1: 4,915

- Joined: Mar 24, 2010

-

Re: Political Roundtable Part XXIV

I still think lowering the corporate income tax rate is a good idea. I also note that, SD20s take on capital stocks and flows notwithstanding, at the aggregate level capital moves slowly, at least in time frames that seem relevant to us. In a year the amount of capital that's going to repatriate itself in the United States in response to the change in the corporate income tax rate is going to be disappointingly small. I feel dumb for not pointing this out earlier - I worked on computable general equilibrium models for awhile and I know the parameters we put in for all the adjustment elasticities are surprisingly small - like, 0.2. Not much higher than zero, in other words. So the small amount of adjustment we saw this year - basically all the companies just pocketed the tax savings - shouldn't be too surprising. I mean come on, it takes a minute to make a decision to build a big plant in the US and actually do it.

I've been taught all my life to value service to the weak and powerless.

Re: Political Roundtable Part XXIV

-

dckingsfan

- RealGM

- Posts: 36,025

- And1: 21,166

- Joined: May 28, 2010

Re: Political Roundtable Part XXIV

Zonkerbl wrote:Let's talk about taxes as a share of GDP

https://www.oecd.org/tax/tax-policy/revenue-statistics-highlights-brochure.pdf

This statistic includes central, state, and local revenue. The united states, in 2017, had a revenue to GDP ratio of 27.1%. The OECD average was 34.2%.

So not only does the United States have criminally unequal income and wealth distributions, it also does not come close to collecting enough revenue to provide services expected of a developed country.

The billionaires have done a good job, until Trump came along, of hiding how much damage they are doing to the fabric of democracy by undermining the institutions that normally prevent citizens of developed countries from descending into poverty. Namely, healthcare and access to higher education. It is historically logical and *inevitable* that the party that does not explicitly represent the plutocrats must make forcing the wealthy to contribute their fair share - which clearly they are *not* - one of their primary platforms.

If you dig into table 1 a little you can see that even before the $1.5 trillion tax giveaway to the wealthy occurred, the US was getting a lot of revenue from income taxes and relatively little revenue from corporate income taxes. Interestingly, we get a rather high percent of our revenue from property taxes, because of our state and county level property taxes, which is apparently not such a big thing in other countries. Other countries also have a VAT, but I guess that's a different conversation.

Hey Zonk, the OECD tables are incorrect. The US pays over 40% of GDP in taxes.

https://commons.wikimedia.org/wiki/File:Federal,_state,_and_local_tax_revenue_as_a_percent_of_GDP.pdf

Re: Political Roundtable Part XXIV

-

dckingsfan

- RealGM

- Posts: 36,025

- And1: 21,166

- Joined: May 28, 2010

Re: Political Roundtable Part XXIV

I am trying to figure out if we are trying to make things more fair or if we are just trying to punish a certain type of individual (say Warren Buffet).

If we want to make things more fair - then we should be looking at effective tax rates after government subsidies. We should be looking at a fairer tax code with little to no wiggle room on carveouts. And of course, we know those government services are key to a better life, so we should want to consistently improve those social services.

Instead, we have been misdirected toward the evil 1% (call him Warren) that isn't paying his fair share. When actually, Warren wants to pay his fair share but no more than the next guy in his group (one doesn't want to be perceived as a dunce). He wants to know that his tax dollars are going to go to an ever improving government (lest he thinks he is just wasting his time and treasure).

If we just want to vilify the wealthy - that should be fun - but probably not that productive.

If we want to make things more fair - then we should be looking at effective tax rates after government subsidies. We should be looking at a fairer tax code with little to no wiggle room on carveouts. And of course, we know those government services are key to a better life, so we should want to consistently improve those social services.

Instead, we have been misdirected toward the evil 1% (call him Warren) that isn't paying his fair share. When actually, Warren wants to pay his fair share but no more than the next guy in his group (one doesn't want to be perceived as a dunce). He wants to know that his tax dollars are going to go to an ever improving government (lest he thinks he is just wasting his time and treasure).

If we just want to vilify the wealthy - that should be fun - but probably not that productive.

Re: Political Roundtable Part XXIV

-

stilldropin20

- RealGM

- Posts: 11,370

- And1: 1,233

- Joined: Jul 31, 2002

-

Re: Political Roundtable Part XXIV

Zonkerbl wrote:I'm talking about taking money from foreign lobbyists and making it look like they're US citizens, like the NRA did and Trump did during his inauguration. I'm talking about defrauding US taxpayers out of hundreds of millions of dollars of tax revenue by creatively revaluing your real estate assets. Setting up fraudulent online universities and getting away with it scott free. Creating charities to avoid paying taxes and then using it as your personal piggy bank. Creating a culture of corruption, where billionaires think laws are only for the little people to abide by. Putting the US government up to the highest bidder. Utterly destroying Democracy in favor of Plutocracy.

Ax murderers, JFC. Who gives a ****?

ok point taken. i thought you were talking prison reform overall. because the best way to prsion reform is to make crime anathema to the entire family and social network like it is in Japon. crime is almost non existent in japon because of the dishonor it brings to self, family, friends, children. <--thats the way to reform crime. all crime. white collar and the horrific atrocities of murder and rape.

but...to your point...if your using crime reform to go after multimillionaires so as to level the playing field...it really just comes down to one thing. Tax reform. everything you mention can be dealt with the stroke of the pen.

the biggest atrocities in our current tax code is the carve outs and loop holes for foundations, trusts, non-profits.

5.3% of our entire US workforce is employed by "non" profits.

i know monte doesn't want to hear but the wealthy use these foundations and non profits to almost solely to protect their wealth. By law they only have to donate 5-10% of their annual revenue to a charity or to help others. They can expense out 90-95% of their revenue on salaries, travel, marketing, rent, mortgage, etc. etc. even worse...the biggest non profits are doing work in medicine...writing off massive corporate income by donating to ...say...the Gates foundation where the foundation is expensing out massive amount of R n D for futuristic medicine of which they WILL sell for massive future profits. "research and development" is the biggest crap write off that exists! If a corporations gets to write off research then an individual should get to write off the entire cost of their education (which is nothing more than research and development of the mind. The largest corporations are off setting massive amounts of revenue in R n D which secures their ability to continue to make products in the future for massive profits...where they often "spin off" more and more pieces of the initial corporation into separate entities as the current R n D pays off on futures products. rinse and repeat...over and over and over...never paying more than capital gains in taxes (if that) as they release shares of the newly spun off corporate entity to the public for purchase...but even then...they never realize the gains. Why? They dont need to. their foundations and non-profits can pay for all their personal expenses. They simply dont need to realize income. ever. Instead their equity grows and grows and grows and they borrow against that equity (at 3% rates and less) if they need to make a personal purchase for something major that just cant be expensed out in the foundation (which is rare if ever). I mean they often just make corporate loans to themselves personally at 0% interest. And its legal! Their foundations can loan their corporations money. loan themselves money. so on and so forth.

here...imagine...i own microsoft. and microsoft is being sued for anti trust...what do i do? Start a foundation and "donate" nearly all of microsofts and my personal wealth to the Bill and melinda gates foundation...which for all of its so called "giving" is worth more than when the initial $50 billion endowment occured. I then use revenue form MSFT to purchase internet providers, and satellite technology, wireless technology and distrution as well as bandwidth reducing communications so as to be a leading developer of the futuristic "internet of things" where everything will be communicating with everything else and apple and msft will generate massive revenue, improve stock valuations, spin off this technology into new entitites separate from msft and apple that will have massive market caps...with minimal wealth realized for tax purposes...no major players are paying any tax on this massive amount of wealth generated because they are not converting shares to cash in a personal account.

you know...one of the things i get to do as a realtor..is to look up every single parcel of property where i am licensed and registered and see who "owns" the real estate. And almost everyone that is at least "somewhat" wealthy owns (even their personal home) in a trust or foundation. There is a reason for that.

Bottom line: fix the tax code. The problem is not "white collar criminals." rather the the current tax code itself is criminal theft compared to the lack of write offs for the middle class guy. That said, the poor also rip off the rest of us...but only because they either refuse to engage in society and work or their wages are too low. FTR, ivd supported a minimum wage hike in this thread since i entered it. Minimum $15-25 per hour depending on region. I support e-verify. I support tariffs on imported goods.

all of which means i also support a hidden (spending) tax on the middle class. We americans need to pay more for our goods...and produce more of them right here in the USA. We need to trade more with canada and mexico and europe and less with china. There is no reason to keep propping up communist china.

1. fix trade first with painful tariffs so we import less goods.

2. crash foreign asian markets in the process.

3. increase minimum wage. e-verify

4. once wealth and corporations are repatriated, then rewrite the tax codes to remove these ridiculous carve outs and loop holes that favor the ruling class.

5. hit the elites with a REAL and harsh inheritance tax. 50% or higher on wealth over $20 million...hit trusts, foundations and non profits with the same tax...right now...they can simply distribute from one non profit to another tax free.<--thats criminal!! it must be changed.

like i said, its a full rebuild.

Re: Political Roundtable Part XXIV

-

stilldropin20

- RealGM

- Posts: 11,370

- And1: 1,233

- Joined: Jul 31, 2002

-

Re: Political Roundtable Part XXIV

dckingsfan wrote:I am trying to figure out if we are trying to make things more fair or if we are just trying to punish a certain type of individual (say Warren Buffet).

If we want to make things more fair - then we should be looking at effective tax rates after government subsidies. We should be looking at a fairer tax code with little to no wiggle room on carveouts. And of course, we know those government services are key to a better life, so we should want to consistently improve those social services.

Instead, we have been misdirected toward the evil 1% (call him Warren) that isn't paying his fair share. When actually, Warren wants to pay his fair share but no more than the next guy in his group (one doesn't want to be perceived as a dunce). He wants to know that his tax dollars are going to go to an ever improving government (lest he thinks he is just wasting his time and treasure).

If we just want to vilify the wealthy - that should be fun - but probably not that productive.

screw warren! screw them all! including the trumps!

the entire premise of this country was to get away from the monarchy, oligarchy rule. and its the money (wealth) that gives them the (power).

The purpose of money (silver, gold, talley sticks, paper, electronic) was to make it plentiful and abundant so as to encourage the transfer of goods and services. just not overly abundant so as to devalue it. we simply dont need hoarders. and i dont care what the Warren's, trumps, gates, job's and bezos' think of government...in fact it is their hand in government and media that is ruining government. if government is bad...its because of the elites having too much money so as to persuade politicians to act in the benefit of the few and against the benefit of the many.

like i said, its a full rebuild.

Re: Political Roundtable Part XXIV

-

Zonkerbl

- Retired Mod

- Posts: 9,330

- And1: 4,915

- Joined: Mar 24, 2010

-

Re: Political Roundtable Part XXIV

dckingsfan wrote:Zonkerbl wrote:Let's talk about taxes as a share of GDP

https://www.oecd.org/tax/tax-policy/revenue-statistics-highlights-brochure.pdf

This statistic includes central, state, and local revenue. The united states, in 2017, had a revenue to GDP ratio of 27.1%. The OECD average was 34.2%.

So not only does the United States have criminally unequal income and wealth distributions, it also does not come close to collecting enough revenue to provide services expected of a developed country.

The billionaires have done a good job, until Trump came along, of hiding how much damage they are doing to the fabric of democracy by undermining the institutions that normally prevent citizens of developed countries from descending into poverty. Namely, healthcare and access to higher education. It is historically logical and *inevitable* that the party that does not explicitly represent the plutocrats must make forcing the wealthy to contribute their fair share - which clearly they are *not* - one of their primary platforms.

If you dig into table 1 a little you can see that even before the $1.5 trillion tax giveaway to the wealthy occurred, the US was getting a lot of revenue from income taxes and relatively little revenue from corporate income taxes. Interestingly, we get a rather high percent of our revenue from property taxes, because of our state and county level property taxes, which is apparently not such a big thing in other countries. Other countries also have a VAT, but I guess that's a different conversation.

Hey Zonk, the OECD tables are incorrect. The US pays over 40% of GDP in taxes.

https://commons.wikimedia.org/wiki/File:Federal,_state,_and_local_tax_revenue_as_a_percent_of_GDP.pdf

Ok, so I posted a number from an organization that makes an effort to calculate things in a consistent way across countries, an organization that is well known and has a specific mandate to do this kind of analysis.

You post a random number from wikipedia that apparently is sourced from some for-profit place that I've never heard of before. What am I supposed to do with that?

I've been taught all my life to value service to the weak and powerless.

Re: Political Roundtable Part XXIV

-

Zonkerbl

- Retired Mod

- Posts: 9,330

- And1: 4,915

- Joined: Mar 24, 2010

-

Re: Political Roundtable Part XXIV

dckingsfan wrote:I am trying to figure out if we are trying to make things more fair or if we are just trying to punish a certain type of individual (say Warren Buffet).

If we want to make things more fair - then we should be looking at effective tax rates after government subsidies. We should be looking at a fairer tax code with little to no wiggle room on carveouts. And of course, we know those government services are key to a better life, so we should want to consistently improve those social services.

Instead, we have been misdirected toward the evil 1% (call him Warren) that isn't paying his fair share. When actually, Warren wants to pay his fair share but no more than the next guy in his group (one doesn't want to be perceived as a dunce). He wants to know that his tax dollars are going to go to an ever improving government (lest he thinks he is just wasting his time and treasure).

If we just want to vilify the wealthy - that should be fun - but probably not that productive.

I think it's pretty clear here that we are all talking about getting the wealthy to pay their fair share, that the US government could and should collect more revenue and it is the absurdly wealthy, who just gave themselves a $1.5 trillion tax break, who need to go first.

It's not about fair treatment (which would result in the wealthy paying much less than they pay now). It's about getting the wealthy to contribute their share.

It's not about punishing people. It's about getting the wealthy to contribute their share.

It's not about vilifying people. It's about getting the wealthy to contribute their share.

It almost feels like you think you can't win an argument about getting the wealthy to contribute their share, and feel you need to change the argument to something else that you think you can win. Maybe the real problem is that asking the wealthy to contribute more is the right thing to do.

I've been taught all my life to value service to the weak and powerless.

Re: Political Roundtable Part XXIV

-

dckingsfan

- RealGM

- Posts: 36,025

- And1: 21,166

- Joined: May 28, 2010

Re: Political Roundtable Part XXIV

Zonkerbl wrote:dckingsfan wrote:Zonkerbl wrote:Let's talk about taxes as a share of GDP

https://www.oecd.org/tax/tax-policy/revenue-statistics-highlights-brochure.pdf

This statistic includes central, state, and local revenue. The united states, in 2017, had a revenue to GDP ratio of 27.1%. The OECD average was 34.2%.

So not only does the United States have criminally unequal income and wealth distributions, it also does not come close to collecting enough revenue to provide services expected of a developed country.

The billionaires have done a good job, until Trump came along, of hiding how much damage they are doing to the fabric of 2C_and_local_tax_revenue_as_a_percent_of_GDP.pdf.jpg[/img]

democracy by undermining the institutions that normally prevent citizens of developed countries from descending into poverty. Namely, healthcare and access to higher education. It is historically logical and *inevitable* that the party that does not explicitly represent the plutocrats must make forcing the wealthy to contribute their fair share - which clearly they are *not* - one of their primary platforms.

If you dig into table 1 a little you can see that even before the $1.5 trillion tax giveaway to the wealthy occurred, the US was getting a lot of revenue from income taxes and relatively little revenue from corporate income taxes. Interestingly, we get a rather high percent of our revenue from property taxes, because of our state and county level property taxes, which is apparently not such a big thing in other countries. Other countries also have a VAT, but I guess that's a different conversation.

Hey Zonk, the OECD tables are incorrect. The US pays over 40% of GDP in taxes.

https://commons.wikimedia.org/wiki/File:Federal,_state,_and_local_tax_revenue_as_a_percent_of_GDP.pdf

[img]https://upload.wikimedia.org/wikipedia/commons/thumb/3/37/Federal%2C_state%2C_and_local_tax_revenue_as_a_percent_of_GDP.pdf/page1-798px-Federal%2C_state%

Ok, so I posted a number from an organization that makes an effort to calculate things in a consistent way across countries, an organization that is well known and has a specific mandate to do this kind of analysis.

You post a random number from wikipedia that apparently is sourced from some for-profit place that I've never heard of before. What am I supposed to do with that?

Hey Zonk, the Wikimedia link is just an addition of the two Fred graphs - federal and state and local. That is what gets us to those numbers. Pretty sure that the OECD even acknowledged that they were wrong - can't find the resource though. Regardless, we are way over 34.2%.

Re: Political Roundtable Part XXIV

-

stilldropin20

- RealGM

- Posts: 11,370

- And1: 1,233

- Joined: Jul 31, 2002

-

Re: Political Roundtable Part XXIV

count me in the group that says anyone with over $10-50 million has too much money. I'm ok with millionaires. even as much as $20-25 million (USD 2019).

but after that its just hoarding for the sake of hoarding. and worse too much power in one central place and abuse of power via wealth is rampant.

The "poor" also abuse the system. I know small business owners like my mechanic that fixes up my antique motorcycle collection. He brings in about $300K in revenue and expenses out the rest of his income by purchasing antique motorcycles from people that cant pay their bills. He now owns over 500 motorcycles (in a trust) valued at over $10 million (by my estimation). The cost of storing those motorcycle offsets his annual corporate income as they are stored in his corporate warehouse and the trust pays no rent. and get this. his kids are on public aid medical insurance!! So they can get other benefits as well if they qualify for that...and I'm quite sure he pays no taxes.The trust owns his home. So when his wife divorced him she got almost nothing. He is NOT alone!! many small business owners behave exactly this!! They can so long as income is not too high...but even if it does...he just needs to expand and acquire more debt laden equity so as to not realize income.

and he's not even wealthy. just another self employed guy with $300k in annual revenue that should have paid taxes on at least $100K of that annually but instead was able to avoid paying most if not all taxes due to corporate loopholes and good estate planning. His trusts now have over $2 million in equity in antique motorcycles but no one would ever know because its held in a trust and essentially (sweat equity because he fixed them all up as a hobby). and this aint something the IRS can go after either. his business can donate the motorcycles to his trusts not only tax free but also get a write off. and his corporation can pay him whatever he wants so long as everything else is expensed out.

In the future he might open up a bar with a big showroom for antique motorcycle enthusiast...rent these out...or just sell tickets for people to walk through. its actually a genius idea (that i thought of)...but no different than the continued acquisition of real estate. These motorcycles will retain their value over time. and even appreciate.

but this guy is NOT the problem. The problem are the tax codes! the tax codes are criminal. not those that use the loop holes. Those that use the loop holes are simply intelligent.

but after that its just hoarding for the sake of hoarding. and worse too much power in one central place and abuse of power via wealth is rampant.

The "poor" also abuse the system. I know small business owners like my mechanic that fixes up my antique motorcycle collection. He brings in about $300K in revenue and expenses out the rest of his income by purchasing antique motorcycles from people that cant pay their bills. He now owns over 500 motorcycles (in a trust) valued at over $10 million (by my estimation). The cost of storing those motorcycle offsets his annual corporate income as they are stored in his corporate warehouse and the trust pays no rent. and get this. his kids are on public aid medical insurance!! So they can get other benefits as well if they qualify for that...and I'm quite sure he pays no taxes.The trust owns his home. So when his wife divorced him she got almost nothing. He is NOT alone!! many small business owners behave exactly this!! They can so long as income is not too high...but even if it does...he just needs to expand and acquire more debt laden equity so as to not realize income.

and he's not even wealthy. just another self employed guy with $300k in annual revenue that should have paid taxes on at least $100K of that annually but instead was able to avoid paying most if not all taxes due to corporate loopholes and good estate planning. His trusts now have over $2 million in equity in antique motorcycles but no one would ever know because its held in a trust and essentially (sweat equity because he fixed them all up as a hobby). and this aint something the IRS can go after either. his business can donate the motorcycles to his trusts not only tax free but also get a write off. and his corporation can pay him whatever he wants so long as everything else is expensed out.

In the future he might open up a bar with a big showroom for antique motorcycle enthusiast...rent these out...or just sell tickets for people to walk through. its actually a genius idea (that i thought of)...but no different than the continued acquisition of real estate. These motorcycles will retain their value over time. and even appreciate.

but this guy is NOT the problem. The problem are the tax codes! the tax codes are criminal. not those that use the loop holes. Those that use the loop holes are simply intelligent.

like i said, its a full rebuild.

Re: Political Roundtable Part XXIV

-

dckingsfan

- RealGM

- Posts: 36,025

- And1: 21,166

- Joined: May 28, 2010

Re: Political Roundtable Part XXIV

Zonkerbl wrote:dckingsfan wrote:I am trying to figure out if we are trying to make things more fair or if we are just trying to punish a certain type of individual (say Warren Buffet).

If we want to make things more fair - then we should be looking at effective tax rates after government subsidies. We should be looking at a fairer tax code with little to no wiggle room on carveouts. And of course, we know those government services are key to a better life, so we should want to consistently improve those social services.

Instead, we have been misdirected toward the evil 1% (call him Warren) that isn't paying his fair share. When actually, Warren wants to pay his fair share but no more than the next guy in his group (one doesn't want to be perceived as a dunce). He wants to know that his tax dollars are going to go to an ever improving government (lest he thinks he is just wasting his time and treasure).

If we just want to vilify the wealthy - that should be fun - but probably not that productive.

I think it's pretty clear here that we are all talking about getting the wealthy to pay their fair share, that the US government could and should collect more revenue and it is the absurdly wealthy, who just gave themselves a $1.5 trillion tax break, who need to go first.

It's not about fair treatment (which would result in the wealthy paying much less than they pay now). It's about getting the wealthy to contribute their share.

It's not about punishing people. It's about getting the wealthy to contribute their share.

It's not about vilifying people. It's about getting the wealthy to contribute their share.

It almost feels like you think you can't win an argument about getting the wealthy to contribute their share, and feel you need to change the argument to something else that you think you can win. Maybe the real problem is that asking the wealthy to contribute more is the right thing to do.

First, I don't think it is fair to lump in all super rich - lots of the most wealthy did not support the recent tax cuts (I would say a majority).

Second, contribute their share is nebulous. What is that share? Its easy to say share without a definition. And what is the goal for the additional revenue? Its easy to say, pay more until I say when vs. here is where we will spend the receipts.

I know you are only talking about the super rich but... it isn't like we aren't doing anything. We just aren't doing anything very efficiently. Or to put it another way, our social services are very inefficient and aren't getting the receipts we take in to those that need them.

Re: Political Roundtable Part XXIV

-

Ruzious

- Retired Mod

- Posts: 47,909

- And1: 11,582

- Joined: Jul 17, 2001

-

Re: Political Roundtable Part XXIV

Wizardspride wrote:?s=19

His willful intellectual dishonesty - and pride he seems to take in it - are beyond disgusting - not just for a president but for any human being. And overall, he's a case study in character flaws. Were we really too stupid to get that?

"A common mistake that people make when trying to design something completely foolproof is to underestimate the ingenuity of complete fools." - Douglas Adams

Re: Political Roundtable Part XXIV

-

stilldropin20

- RealGM

- Posts: 11,370

- And1: 1,233

- Joined: Jul 31, 2002

-

Re: Political Roundtable Part XXIV

-

Zonkerbl

- Retired Mod

- Posts: 9,330

- And1: 4,915

- Joined: Mar 24, 2010

-

Re: Political Roundtable Part XXIV

dckingsfan wrote:Zonkerbl wrote:dckingsfan wrote:democracy by undermining the institutions that normally prevent citizens of developed countries from descending into poverty. Namely, healthcare and access to higher education. It is historically logical and *inevitable* that the party that does not explicitly represent the plutocrats must make forcing the wealthy to contribute their fair share - which clearly they are *not* - one of their primary platforms.

If you dig into table 1 a little you can see that even before the $1.5 trillion tax giveaway to the wealthy occurred, the US was getting a lot of revenue from income taxes and relatively little revenue from corporate income taxes. Interestingly, we get a rather high percent of our revenue from property taxes, because of our state and county level property taxes, which is apparently not such a big thing in other countries. Other countries also have a VAT, but I guess that's a different conversation.

Hey Zonk, the OECD tables are incorrect. The US pays over 40% of GDP in taxes.

https://commons.wikimedia.org/wiki/File:Federal,_state,_and_local_tax_revenue_as_a_percent_of_GDP.pdf

[img]https://upload.wikimedia.org/wikipedia/commons/thumb/3/37/Federal%2C_state%2C_and_local_tax_revenue_as_a_percent_of_GDP.pdf/page1-798px-Federal%2C_state%

Ok, so I posted a number from an organization that makes an effort to calculate things in a consistent way across countries, an organization that is well known and has a specific mandate to do this kind of analysis.

You post a random number from wikipedia that apparently is sourced from some for-profit place that I've never heard of before. What am I supposed to do with that?

Hey Zonk, the Wikimedia link is just an addition of the two Fred graphs - federal and state and local. That is what gets us to those numbers. Pretty sure that the OECD even acknowledged that they were wrong - can't find the resource though. Regardless, we are way over 34.2%.

So it double counts transfers from the federal to state?

I've been taught all my life to value service to the weak and powerless.