CrowderKeg wrote:

Sadly that GM is probably Pat Riley or Danny Ainge

Moderators: bisme37, Parliament10, canman1971, shackles10, snowman, Froob, Darthlukey, Shak_Celts

CrowderKeg wrote:

GoCeltics123 wrote:CrowderKeg wrote:

Sadly that GM is probably Pat Riley or Danny Ainge

CelticsLV wrote:Captain_Caveman wrote:Curmudgeon wrote:Florida has no state income tax. That's Miami's first selling point. The Second is that they went 30-11 for the second half of the season: a 60-win pace. And with Bosh off the payroll, Miami has more cap space than Boston,

The taxes doesn't really work like that. They pay state taxes depending on where the games are played, for starters. So it is much less of an advantage than people have claimed. Been several illuminating articles about this from tax lawyers who work with pro athletes.

No doubt that they are an attractive FA destination, but easy to get carried away with that first point. Also really to overstate the value of the end of season record. Heat were a .500 team that didn't even make the playoffs last year, and would be no better than the Jazz team that he'd be leaving.

A Dragic/Hayward/Whiteside/Winslow/Tyler Johnson core is not going to get it done.

IT/Fultz/Hayward/Crowder/Horford will not either. Heat match up better against Cavs than we. They actually have a legit body to put against LeBron - James Johnson who was playing really well for them. Crowder + Horford vs Love + Thompson is a joke. Our only hope against Thompson would be rookie Zizič? We're still filled with pussies in the frontcourt and undersized in general. If Ainge doesn't give Hayward a win now plan then i see no advantage for us. It's a toss up to be fair.

Curmudgeon wrote:Captain_Caveman wrote:Curmudgeon wrote:Florida has no state income tax. That's Miami's first selling point. The Second is that they went 30-11 for the second half of the season: a 60-win pace. And with Bosh off the payroll, Miami has more cap space than Boston,

The taxes doesn't really work like that. They pay state taxes depending on where the games are played, for starters. So it is much less of an advantage than people have claimed.

It's a significant advantge. First, NBA teams play 41 home games. So (in the case of a player on a Florida team) 50% of current earned income is apportioned to Florida. Some is apportioned to other states with no state income tax, e.g. Texas. Second, Hayward almost certainly has income from a portfolio of investments made from the money he earned in prior years (unless his agent is a complete boob). In Massachusetts, cap gains from those investments are taxed at !2%, which is tacked on to the federal rate. (Short-term cap gains are taxed by the feds as ordinary income. Long-term gains are taxed at 20% for taxpayers in the highest brackets.) Third, any dividends from stock or other investments are not taxed in Florida. Neither are royalties or any other form of income characterized as "ordinary" by the IRS. Fourth, depending on where he lives, local property taxes are much lower in Florida. Municipal services are cheaper (e.g. no snow removal, lower labor costs) and per pupil expenditures in the schools are lower.

Of course there are tradeoffs. If he comes to Boston and lives in Weston, Wellesley or one of the other toney Western suburbs, he can send his kids to the public schools, which are outstanding. If he lives in the Miami area, he probably has to put them in private schools if he wants the best education for them. Also, states with no income tax tend to have regressive state sales taxes. He will pay no sales tax in Massachusetts on food purchased in a grocery store (with some exceptions) although he will pay 6.25% on restaurant meals. In Florida the tax is 6% on everything.

Curmudgeon wrote:The difference is more like a million dollars to two million dollars a year for the most highly compensated players when you consider cap gains and other investment income. It's not trivial, and more than some folks earn in a lifetime. For example, the MA income tax is 5%. For a player earning $20M, that's one million dollars.

Don't just look at the player's salary. Look at investment income and income from commercials, endorsements, sneaker deals, etc.

In baseball, it would also include jersey sales, but not in the NBA. The players have signed away their rights to "NBA Properties" but do get an indirect benefit in that jersey sales contribute to BRI and hence help raise the salary cap.

Fidel Sarcasmo wrote:ermocrate wrote:CrowderKeg wrote:Were you in a coma this season?

And it's more difficult to become an All-Star in the loaded West. He's only going to get more efficient playing for his ex-coach in a better system. I wouldn't be surprised if he surpasses Butler and George during his time with the Celtics. His numbers were already comparable to both this past season.

Well this is the NBA manifesto, they made a congrats card out of a picture where he is making an illegal dribble... Fantastic, they don't even try to hide this s**t anymore.

Lol. While we are at it, we should photoshop a can of beer in his other hand or a Bowie knife

Captain_Caveman wrote:Curmudgeon wrote:Captain_Caveman wrote:

The taxes doesn't really work like that. They pay state taxes depending on where the games are played, for starters. So it is much less of an advantage than people have claimed.

It's a significant advantge. First, NBA teams play 41 home games. So (in the case of a player on a Florida team) 50% of current earned income is apportioned to Florida. Some is apportioned to other states with no state income tax, e.g. Texas. Second, Hayward almost certainly has income from a portfolio of investments made from the money he earned in prior years (unless his agent is a complete boob). In Massachusetts, cap gains from those investments are taxed at !2%, which is tacked on to the federal rate. (Short-term cap gains are taxed by the feds as ordinary income. Long-term gains are taxed at 20% for taxpayers in the highest brackets.) Third, any dividends from stock or other investments are not taxed in Florida. Neither are royalties or any other form of income characterized as "ordinary" by the IRS. Fourth, depending on where he lives, local property taxes are much lower in Florida. Municipal services are cheaper (e.g. no snow removal, lower labor costs) and per pupil expenditures in the schools are lower.

Of course there are tradeoffs. If he comes to Boston and lives in Weston, Wellesley or one of the other toney Western suburbs, he can send his kids to the public schools, which are outstanding. If he lives in the Miami area, he probably has to put them in private schools if he wants the best education for them. Also, states with no income tax tend to have regressive state sales taxes. He will pay no sales tax in Massachusetts on food purchased in a grocery store (with some exceptions) although he will pay 6.25% on restaurant meals. In Florida the tax is 6% on everything.

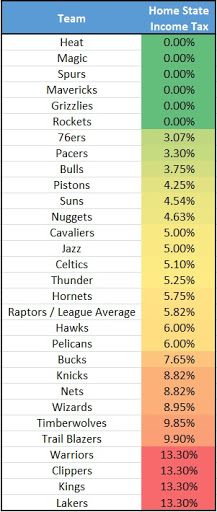

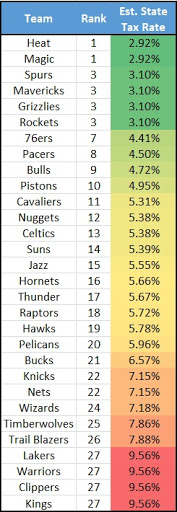

Walking it back a bit to state income tax, still overstated as I understand it. First chart is state tax rates by team. Second chart is adjusted for the schedule of where each team plays its games. On top of that, there are tax credits on the "out-of-state" state taxes you pay in your road games in "tax states" that are not available to players in "no tax states". This brings the state income tax difference down to 1% or so between teams like Miami and Boston. May be a more pronounced advantage over teams like the Knicks or Kings, but not so much us.

As to the higher cost of living and capital gains and the rest, yes, a similar advantage exists, but also easy to overstate. As you said, there are tradeoffs, but there are also loopholes and workarounds and tax credits similar to what I mentioned above.

All told, unless he is the most successful investor alive, we are talking a difference of a few million dollars, to a guy who will probably make $300m+ in his career from salary and endorsements.

ermocrate wrote:Fidel Sarcasmo wrote:ermocrate wrote:Well this is the NBA manifesto, they made a congrats card out of a picture where he is making an illegal dribble... Fantastic, they don't even try to hide this s**t anymore.

Lol. While we are at it, we should photoshop a can of beer in his other hand or a Bowie knife

I'm all in for a head of someone Bron Bron in the right hand and a Machete in the left.

rmal8852 wrote:ermocrate wrote:Fidel Sarcasmo wrote:

Lol. While we are at it, we should photoshop a can of beer in his other hand or a Bowie knife

I'm all in for a head of someone Bron Bron in the right hand and a Machete in the left.

Fixed it for you.

Writebloc wrote:Spoiler:

Y'all don't sleep...

CrowderKeg wrote:Writebloc wrote:Spoiler:

Y'all don't sleep...

...deleted since. Fun while it lasted.

ViperGTS wrote:CrowderKeg wrote:Writebloc wrote:Spoiler:

Y'all don't sleep...

...deleted since. Fun while it lasted.

While it lasted? Sh*t, the fact it was deleted makes it far more interesting and fun. You give up too early...lol.

London2Boston wrote:Who was the member that was willing to make love with Mama Durant for the cause of bringing KD here last year? Keep him away from Wifey Hayward

Just based on knowing what we know today, do you think the Celtics sign Gordon Hayward? – McHale Drop Step

I’m not sure if knowing what we know today is a reference to our overall general knowledge about Hayward’s status or the specific and since-deleted tweet by his wife Sunday in which their daughter was wearing a Go Green shirt with a shamrock on it. I suspect we’re searching a little too hard for meaning with the latter, but my answer is the same either way.

Yes, I do believe the Celtics will sign the offensively talented Jazz forward. I’m convinced of it, actually.

Sure, the Jazz can pay him more money, and there will be other teams that will try to emerge as serious suitors, the Heat apparently being one. But I fully believe in Hayward’s loyalty to Brad Stevens and desire to unite with his college coach again.

Mark Titus, who played high school ball with Hayward, had some insightful info on this in a recent podcast with Bill Simmons. Hayward was something of a late-bloomer as a prospect. Stevens was on him early for Butler and was the first to offer him a scholarship. When bigger schools such as Indiana came after Hayward later on, he nonetheless honored his commitment to Butler. Something tells me he doesn’t regret it.