knickabocker88 wrote:Can't tell if this rally in the equities market is a pump fake or not.

Didn't add much to my taxable brokerage account. I brought 1 share of VOO, 2 VIG and 3 VXUS when the s&p touched 3400 a month ago.

Increased contributions to my 401k tho but that money doesn't really matter.

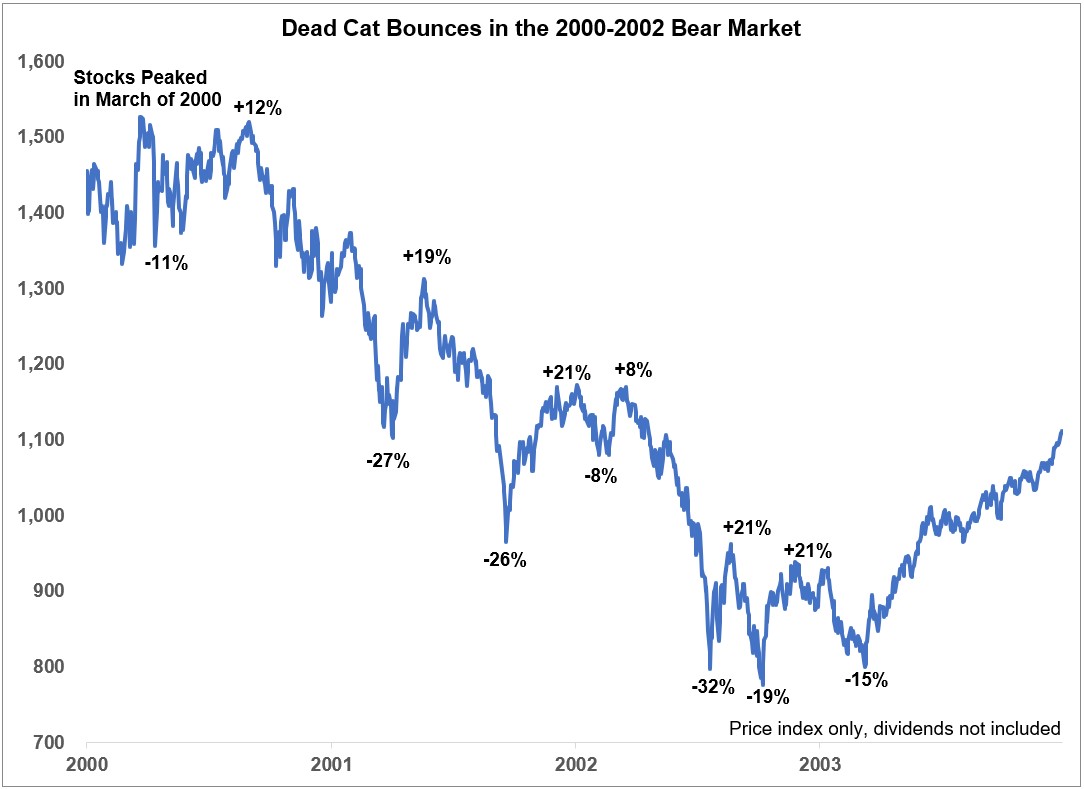

rallies are common in bear markets. we are in a recession, and in a bear market. unfortunately, it's going to get worse.

i'm still continuing to do my weekly (i changed it from monthly) contribution of ~$125 into my roth IRAs. but any of the extra money i'd normally be pumping into the market (not ROTH IRA) I am saving up to pump into the market later, or get a rental property

we will likely see this bear market until 2024. after Spring-ish of 2023, when the market drops ~10-15%+ for me, I will pump some extra dollars in - the extra money i have been saving up since march of last year when i pulled my money out, as it was obvious to see this bear market and recession coming.

i recently lowered my contributions to VXUS. i thought the US was going to go to complete ****, and it'd be smarter to be in international markets (VEA + VWO, or VXUS). i was wrong. the US sucks right now, but the rest of the world is much worse.

i'm going to continue to put in my typical weekly contributions to make sure my ROTH IRA is maxed. extra money will either go into ~10-15% drops, and a future rental property(s).

this girl's video on why you shouldn't "buy the dip" was great - she legit goes through the math, which is crazy to see. that's why i'll continue to do my weekly contribution, but am saving the extra for something else.