Zonkerbl wrote:krii wrote:Zonkerbl wrote:

I haven't read the paper. I skimmed his wikipedia page, saw the words "heterodox" and "austrian school" and stopped reading. My time is valuable and I'm not going to waste it reading a 200 page treatise from some wacko.

I understood that you guys were citing him as support for going to a gold standard. If you've abandoned that argument then you're just gaslighting and there's no point in continuing this discussion.

Well, Zonker - you call yourself a professional economist and yet you '

skip the paper' on which you are debating?

I hate it when other '

scholars' call anything bull or 'heterodox' as if they own ideas and theories are the only applicable in the world econ-system. More pragmatic and implementable in the contemporary markets with current monetary system - yes (because system with a gold standard would need certain other actions that are unlikely to happen in a country like US); the only existing solutions - nope. You know, they are calling it 'theory' for a reason - there are pieces of knowledge written to summarize certain style of thinking. One just cannot imply as if he is the only real piece of economics,

this is bull.

Guess what, there are multiple idiots like him/me! Some of us 'idiots' who are proponents of certain economic schemes are also 'professional economists'; some even teach it and write some articles on it. I am not jumping onto some random forums calling you guys 'idiots' though.

EDIT:

btw. I'd love to discuss this topic but first things first - I have some meetings to do, I might try to write something on that later on.

Bullcrap. You're coming into this discussion for the first time demanding I read some cuckoo's 200 page thesis? Drop dead. I don't rely on dead crazy people for my ideas. I am capable of thinking for myself and writing and defending those ideas in real time in the discussion we are having right here in this forum.

You don't get to say "well you didn't read this paper..." You want to convince me? Make the argument yourself without referencing the dead guy.

Like I said earlier, going to the gold standard is stupid. Just to be clear, that means you are stupid for advocating it. And I weep for my profession if idiots like you are teaching economics.

Oh geez.

Well we are discussing economics - you may have heard that some people have written quite a few books on these topics. Whenever you are 'making the argument yourself' usually (intentionally or not) you are referring to some guys. And quite a few of them are dead, such life. And you're right, idiots - like me - teaching econ subjects is just brutal. We are teaching in quite a few places around the world, including George Mason University, Oxford and (my

alma mater) University of London - I know, idiots everywhere ... especially here in Europe, bunch of uneducated cuckoos.

By the way Rothbard wasn't 'some dead guy'. He was one of the most influential and original economists of the XXth century, at least pretend you've been studying anything in the past. I don't know who was your econ history professor but certainly never achieved good standards. This '200 page thesis' is probably the best available criticism of FED policy, like it or not. Even proponents of FED policy refers to this position.

I'm not saying that gold standard is the only thing you can do to build stable and prospective economy. It's just your conviction of your own knowledge superiority (so characteristic for Keynesians) that made me leaving a comment here. See, I have problems with posting in random political topics because people are getting too emotional with their views and they lack of proper conversational skills (such as acceptance of others' vision). It usually ends up in a bad way. You - for instance - do not want to 'waste your time' to read a few basic critiques of certain policies. Of course I can summarize them in 2 sentences but you wouldn't be able to understand what is behind this argumentation, hence you'd lack the very substantial importance of Rothbard/Murphy/Mises 's reasoning. You would probably state that my opinion is 'bullcrap', full stop. I'd like to refer to some author that was arguing for certain actions (such as Rothbard's book quoted by AFM or Mises in his '

Theorie des Geldes und der Umlaufsmittel' [The Theory of Money and Credit]) but you will say it's a piece of shite that was written by some drunk Austrian wackoo. See my point? But okay, for purposes of this single post I'd at least try and provide you some article that explains why associating gold standard with Great Depression is purely incorrect. Try, at least, to listen to him before saying any '

I'm professionalist. This is bunch of bullshite written by some Biblical moron. I work as an economist. You idiots.' stuff.

You are saying that

'The recessions we had while on the gold and silver standard actually made the Great Depression look mild. Just a terrible, terrible idea proposed by people who have no understanding of economics and no knowledge of our nation's history.'.

Gold Standard was proposed by quite a few economists not as a solution for the US but rather standard for monetary system that would be more stable, according to its proponents. It was applied in the States because back in a days people wanted to have stable economy and they found it convincing. But yeah, you're right except that the US used bimetalic standard since XVIII century: on the beginning it was silver and gold, between 1834 and 1850 the model changed for only one metal (gold) which was 'standard' until FED creation in 1913 (except short period during American Civil War). Classic 'standard' was implemented in late 70s of XIXth century, I guess. It was abandoned with FED policy in 30s. In 1972 another policies basically changed gold standard.

Those people who have no understanding of economics and no knowledge of your nation's history never said it was Austrian perspective.

Austrians (such as Rothbard) were just calling for gold standard as the most efficient monetary solution, according to their studies and beliefs.

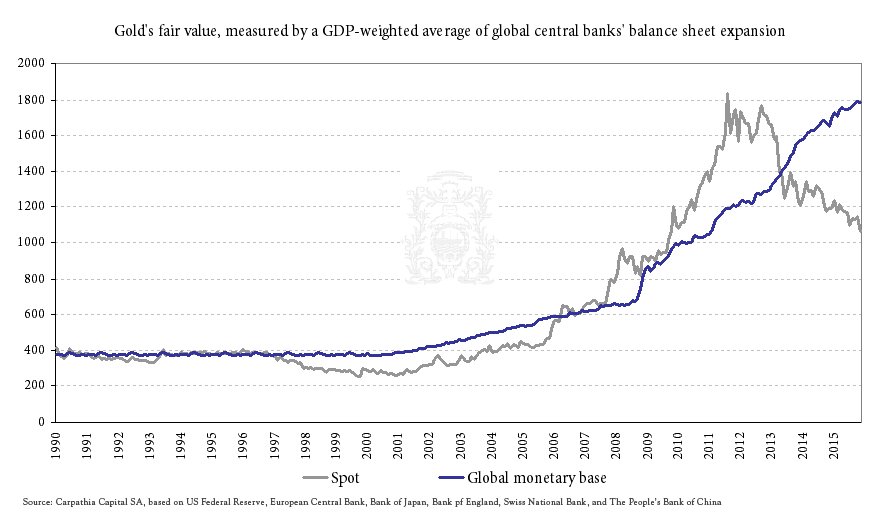

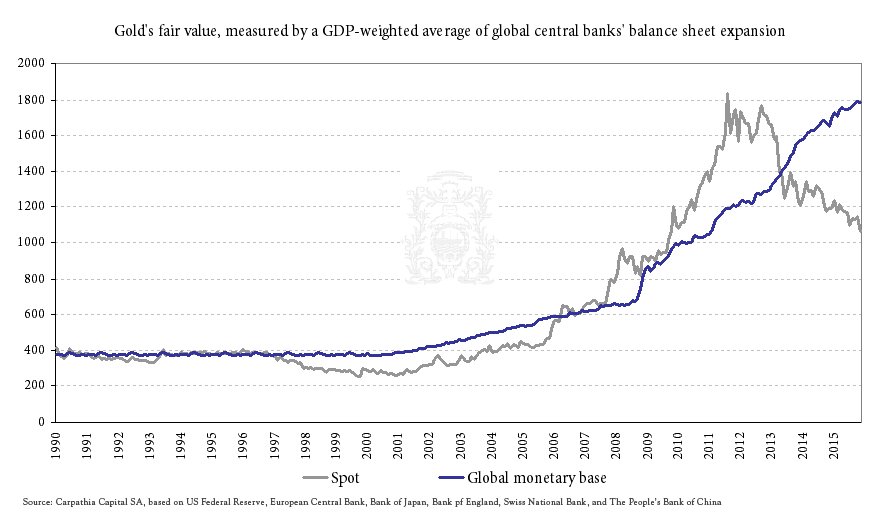

Some interesting data below:

See:

Moreover I'd like to refer to that:

->

http://www.amazon.com/Politically-Incorrect-Guide-Depression-Guides/dp/1596980966or:

->

https://www.youtube.com/watch?v=envGgTVOL_4Paraphrasing Murphy's conclusion - blaming the gold standard for Great Depression is just like blaming gravity for aircraft accident. But I know, you'll say 'USE YOUR ARGUMENT' because everybody knows I cannot share opinions with my colleagues.

By the way it isn't gold standard that you argue against but politicians and economists who are manipulating gold prices. Once again I'd refer to Murphy's:

Source: https://mises.org/library/gold-standard-myths-and-lies(...) Some purists also ask, "Why don't you favor a market-driven price for the dollar and for gold? Just let supply and demand determine prices, not some rigid number picked out of a hat by the politicians."

This objection sounds plausible at first, but it too misses the mark. If the Fed were to say, "We are now announcing a new policy objective of maintaining the price of gold at $2,000 per ounce, from now until the end of time, and we will begin accumulating stockpiles of gold to reassure investors that we will be able to maintain the target," this would not be analogous to the federal government saying, "We are establishing a minimum price of labor at $7.25 per hour."

Under a genuine gold standard, when the Fed "sets" the dollar price of gold it isn't threatening people with fines or jail time if they want to trade gold at a different price. Rather, the Fed (or the government in general, if there were no central bank) would adjust the quantity of dollars in existence to maintain the target. If the forces of supply and demand were such that the market price of gold had drifted upward to, say, $2,025 per ounce, then the Fed (assuming a $2,000 target) would need to sell off some of its gold holdings,1 which would (1) flood the market with more gold and (2) shrink the amount of dollars in the financial system. This contractionary policy would push down the price of gold toward the peg of $2,000.

"Under a genuine gold standard, when the Fed 'sets' the dollar-price of gold it isn't threatening people with fines or jail time if they want to trade gold at a different price."

On the other hand, nobody would be so foolish as to sell his gold for less than $2,000 per ounce, if the Fed (or the Treasury) had a standing invitation for anyone to trade in an ounce of gold in exchange for $2,000 in Federal Reserve notes. Why sell your gold to another private citizen for (say) $1,950 an ounce, when the US government stands prepared to buy unlimited quantities of gold at a fixed price of $2,000 per ounce?

Finally, a critic could (and actually did, on my blog) ask how this arrangement differs from the current one? After all, right now Bernanke "sets" interest rates, but not through literal price controls. Instead, the Fed adjusts the quantity of reserves in the banking sector such that the "market-determined" federal funds rate is close enough to the Fed's target for this interest rate. So isn't this basically the same thing as the gold standard, with a different "good" serving as the monetary commodity?

There are two problems with this sophisticated objection. First, in the current system the Fed has a moving federal-funds target. At best, then, it would be analogous only if the Federal Open Market Committee said after each meeting, "We are now setting the target price of gold at such-and-such dollars. However, if unemployment begins rising and core CPI is under 2 percent, we will begin raising the target price of gold in $10 increments over the next few meetings." That system would be nothing like the classical gold standard.

Yet the deeper problem with the analogy is that on a classical gold standard, the government is (imperfectly) mimicking what would happen if the money were actually gold, with people walking around with gold coins in their pockets, and merchants quoting prices not in dollars but in grains or ounces of gold. The classical gold standard, by fixing the dollar as convertible into a definite and constant weight of gold, doesn't introduce another price: the dollar is supposed to be a claim-ticket to gold. This isn't really "price fixing," any more than defining a foot as 12 inches is "central planning."

In contrast, what would be the free-market analog of the Fed's current strategy of targeting short-term interest rates? The only thing I can think of is if the money commodity in a community weren't something tangible like gold, silver, or tobacco, but rather overnight bonds issued by banks. Yet what is a bond but a promise to deliver money? So how could the money itself be a short-term bond? At this point I am dropping the analogy, lest I become permanently cross-eyed.

If it isn't convincing you to at least try to read / watch some of those 'bullshite heterdox theories' then we will end this discussion in here. I just don't like it when I am called idiot with no reason and I find no reason to discuss it.

Cheers, greets from London.