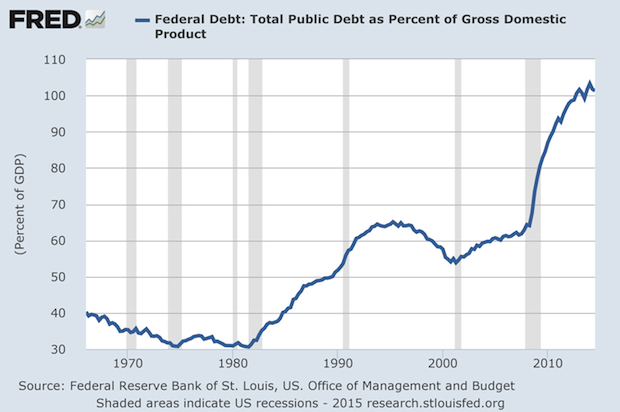

Zonkerbl wrote:dckingsfan wrote:Zonkerbl wrote:I wouldn't necessarily balance the budget. For reasons I've explained before we can have a deficit of about $200 billion without increasing our debt to GDP ratio. But we do need to get that ratio down from 100% to 70%, so we'll have to cut corners.

Yup, this is a hard concept. I think around 50% but I can understand 70%. Either way - we are headed toward 200+% and that is all but unworkable.

Zonkerbl wrote:First thing I would do is cut the military's budget in half, then I would dramatically increase rich people's contribution to medicare and I would increase the retirement cutoff for social security to be equal to the average US life expectancy, plus I would increase the salary cutoff for contributing to SS. I would raise tax revenue by eliminating subsidies for oil production and other corporate tax subsidies.

And you would have both sides screaming. And that is why this has to be a bipartisan approach. Move back retirement cutoffs and Pelosi is going to cry CUTS, CUTs, CUTs. Same with the defense hawks.

Sadly we haven't had one of those approaches since a couple of administrations back...

Zonkerbl wrote:It's really simple to say what has to happen to balance the budget. No one has the cojones to actually *do* it. There's no point in arguing what has to be done - big expenditures have to go down, revenues have to go up. The big ticket items are the military, healthcare expenditures, and social security. The big leakages on the revenues side are the tax cuts over the past 30 years and the maintenance of various tax subsidy handouts to big oil and such.

Although I would point out - we are still at around 20% of GDP for revenue. So, our spending problem >>>>>> than our revenue problem.

Are you saying 20% is too high or too low? I think you could make an argument either way. Given how big our problems are right now I would imagine it should go up to 25% for a few years, to pay for our military adventurism in Iraq. It is the fabulously wealthy who benefited the most from that so it's only fair that they pitch in. Bump up the various investment taxes by 5% or so.

The political unpopularity of all these actions is how we got into this mess in the first place. I'm not a political scientist and I don't know how in the world we will actually get these things implemented. I will say that implementing a little of each - through COMPROMISE - is going to be a lot easier on the economy than forcing one side of the equation to bear the whole burden.

On the tax side, I worry that taking too much more out of the economy in taxes will slow things down. And a lack of growth will hurt our receipts more than the increased taxes will help. (And yes of course, streamlining the tax code would help).

We are at around 40% for state/local taxes at this point. And many of those state and local entities need to raise taxes as well.

I think 20% is about right on the federal side - if you want to inch it up to 21%. Okay. We are running at over 18%, which is too low.

As for the military - if we are willing to take a step back on the world stage, we could get down to 1.5 to 2% of GDP. If we do that - we should cut our contribution the same to the World Bank, UN, etc. But from what I have seen, those progressives on this board want us to take care of the world problems too. As you can see, defense spending (even with our recent incursions) has been coming down - it drives the war hawks crazy

The real ongoing problem is entitlement spending. And you are right - I don't see how that happens until we go Greece. Right now if we took away all discretionary spending, we would get under the line on a federal level. But when you take a look at the overall picture - not so much. We have a spending problem much more than a taxing problem. I think we can agree that the cumulative 40% tax rate is a huge drag on the economy and it isn't going to get better unless we fix it.

This is the best figure I have seen to describe the situation: