TGW wrote:popper wrote:TGW wrote:

Same experiment was done in Kansas with horrible results. You honestly think it's going to work on a macro level?

I do.

Interesting. What's your opinion on the massive tax cuts failing in Kansas? Why do you believe it can work on a macro level even though it fails on a micro level?

I'm no expert obviously but the following explanation makes sense to me.

....The Kansas Republicans were correct, therefore, in assuming that lower tax rates cause greater economic growth. However, like most economists, they assumed that economic growth would show up in the form of increased wages, business revenues, and GDP. They further believed that these additional incomes would result in increased tax revenues that would offset the reduced revenues caused by lowered tax rates.

The problem with this thinking is that economists characteristically attempt to measure economic growth in monetary terms, which comingles two different concepts. Economic growth actually consists of and is defined by an increase in physical goods and services, not an increase in quantities of money. The quantity of money is controlled only by the central bank, and is thus independent of economic growth. The additional supply of goods and services created by economic growth lowers consumer prices relative to wages, which increases real incomes, but not money incomes. The practice of measuring real, physical production in monetary terms led Kansas economic planners into the error of thinking that increased economic growth would result in higher money incomes and thus higher tax revenue from incomes. They were looking in the wrong place for the benefits from lower taxes.

Kansas economic planners also expected decreased unemployment, but that did not materialize, for a different reason. Unemployment, in the long run, is not caused by lack of economic growth or of work available for unemployed workers to perform; it is instead caused by artificially high wage rates at the low end of the wage spectrum (i.e., minimum wage, union legislation, etc.).

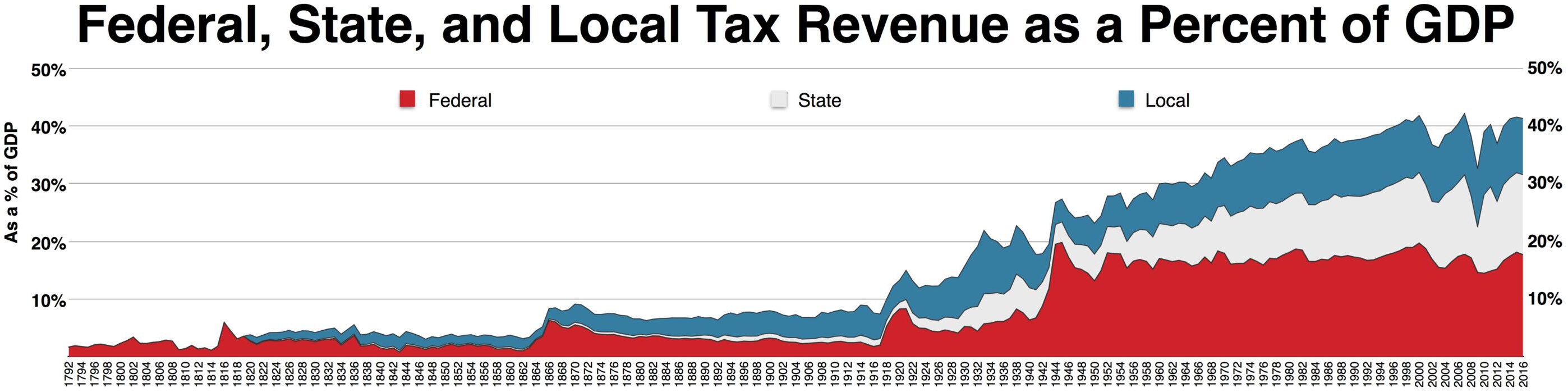

Separate from the above is a bigger picture that critics on all sides ignore. First, it is not the tax rates in a single state that affect economic growth in that state, but the tax rates nationally (as well as international capital flows). Kansas taxpayers received a small 24% reduction on the state income tax they paid, but state income tax is a small portion of all taxes paid. Federal income taxes are more than six times greater, not to mention payroll taxes and other taxes and fees that equally serve to consume the savings that would otherwise be used for capital investment. And, it is not only taxes but also regulations, credit market distortions, and other restrictions on and manipulations of production that impede growth.

Second, the capital that supports production and economic growth in Kansas comes from savers across the country, not just from Kansas. In order to produce an observable result in Kansas, national — not only state — tax reductions would be required. Similarly, the increased savings that wealthy Kansas taxpayers received from tax cuts would not be used only by businesses in Kansas, but by businesses all over the nation. Just as capital from other states flows into Kansas, Kansas capital flows out of Kansas across the nation.

In sum, though every bit of extra capital helps the economy somewhere, it should not be expected that such a small tax cut would benefit Kansans, specifically, to a noticeable degree. Lowering state income taxes helps economic growth, but the benefits are spread nationally and not directly traceable through economic statistics such as GDP, nominal wage growth, or unemployment.

https://mises.org/blog/why-kansass-tax-cut-failure-really-success