bizarro wrote:midranger wrote:People want crypto because they see it's value in fiat going up. When the value in fiat goes down, they want out of crypto see: Ripple. People want more fiat currency by any means necessary, because they can spend it on goods and services.

FWIW, Ripple is the best idea out of all the cryptocurrencies I've read about. But then you have the issue of the company "probably" giving away 1 billion of them every month to banks who will agree to use it for the next what? 55 months? With 55 billion free ripple out there for the banks to use, why will they ever buy yours?

What you describe is a 'Noob'. And, yes, people in every market who rush into s#$% do the same thing.

Let me tell you this, oh wise investor Midranger, I made more money in one week with smart market-based analysis of the Crypto fractal pattern and 50 day average (not remotely parallel to the dinosaur that is S&P) than I did

in the entire life my $10k USD investment in Apple at $30/share. I still hold 30% of my Apple stock. And, frankly, it's just a feather in the portfolio. Like I said, I've been investing since a gradeschooler. I have absolutely no idea what you think you're trying to prove.

And, jeebus, Ripple isn't remotely close to the best idea in the Cryptospace. You think it's the best idea because you think in one linear progession of thought it appears.

I'm glad you're doing well. That's cool. There's a lot of people who have gotten rich with a pull of a slot, buying a lotto ticket, or picking the right penny slot. I'm not coming to them for investment advice either.

It's funny that you talk about how much "money" you've made. Money? I thought that was the enemy? I though it was going extinct?

Just hyperinflated digital bits? Maybe I'm wrong. Maybe someone heavily leveraged in crypto will sell crypto tooth and nail because he wants other people to put their "money" in, so he can cash out for more "money"? You also would have made a lot of "money" had you shorted bitcoin like I suggested on the first page of this thread. Could have nearly doubled your "money" in 7 days. Am I a cryptocurrency genius? I think I may be.

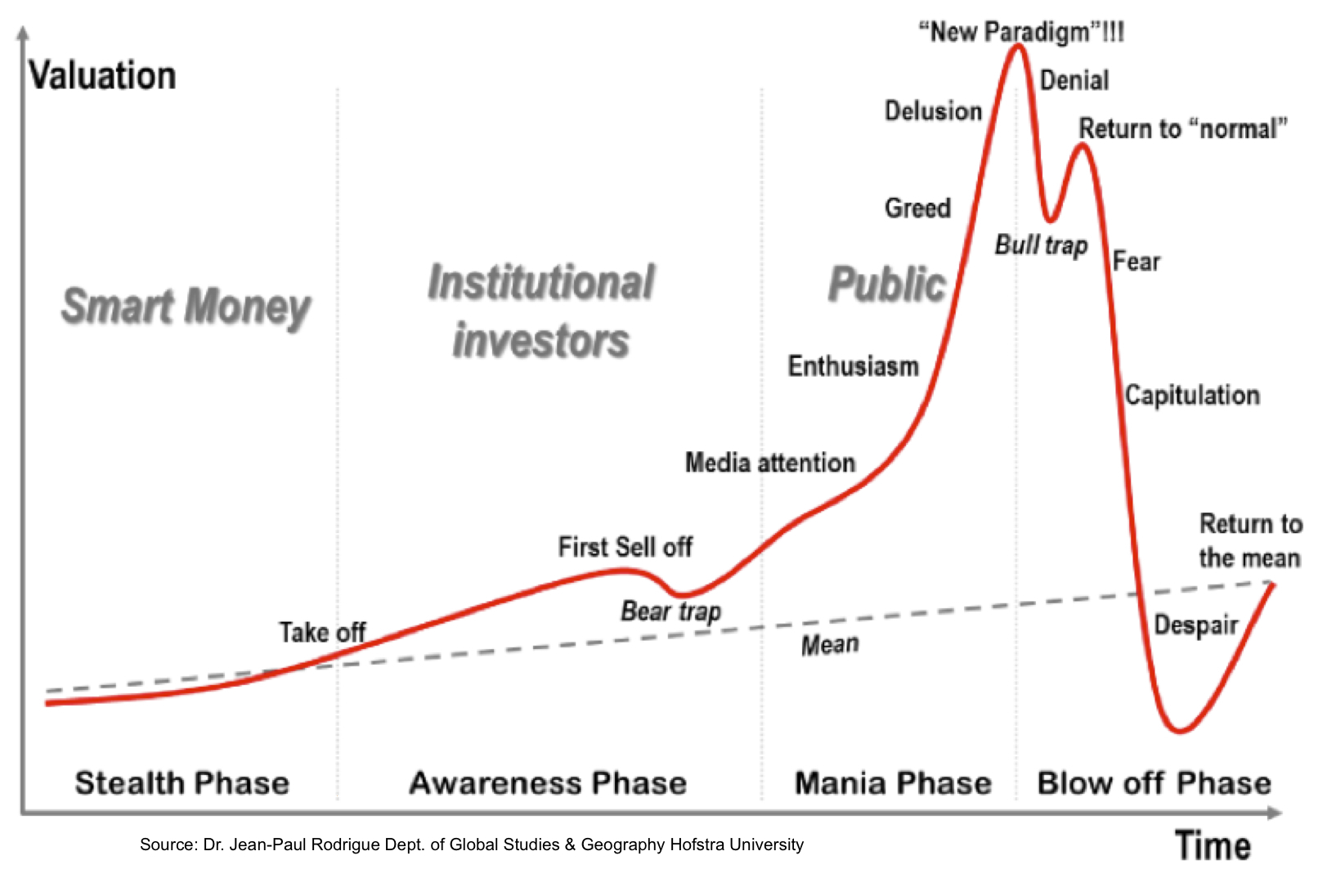

I don't know. I'm here introducing the idea that perhaps cryptocurrency won't be anything but a blip on the historical radar to be laughed at in the future like tulip bulbs. The zealots here have created another echo chamber here, where that point of view isn't even considered. That is fine, but I disagree, and will freely voice that opinion as you freely voice yours.

I'm here to suggest that over the long term, perhaps a well diversified portfolio of traditional investments that have a proven track record for creating wealth for literally anyone who has ever stuck with them over the long haul is a better investment for most people. It won't get you rich quick, but it will get you rich.

Please reconsider your animal consumption.