OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Moderators: MickeyDavis, paulpressey25

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Lippo

- Head Coach

- Posts: 6,057

- And1: 980

- Joined: Jun 15, 2006

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

LINK is booming this year, to the moon link marines...

30x since got in...wooot

30x since got in...wooot

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- jschligs

- General Manager

- Posts: 9,213

- And1: 7,170

- Joined: Jul 20, 2016

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Picked up some Rocket Companies on it's IPO. I was stuck in meetings and didn't get it at the initial $18 but did get low $21, going to hold this one for a while

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Nowak008

- RealGM

- Posts: 14,588

- And1: 4,303

- Joined: Jul 07, 2006

- Location: Book Publisher

- Contact:

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

hege53190 wrote:Nowak008 wrote:JEIS wrote:Pretty good chance Benzo buys out JC Penney's in the near future. He just pulled out $3 billion worth of his Amazon stock... The other bidder offered 1.75 billion. Could be a nice play.

Good suggestion - I'll roll the dice with you.

I am always in for a bargain. However JC Penny has $2.2 Billion in lender debt. The offers in Bankruptcy court were like $1.8 Billion. Out of the $3Billion that Benzo withdrew I would assume that a significant portion is going to taxes (like 20-25%). JC Penney has 320 million shares of common stock outstanding.

I am just not sure how you make money off of this. I am asking because I am curious.

Idiot speculators like me bidding it up?

John Hammond apologists:

emunney wrote:Ron Swanson wrote: 9 YEARS!? like any of that matters

THAT LITERALLY IS HIS TENURE.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- HaroldinGMinor

- RealGM

- Posts: 15,922

- And1: 21,286

- Joined: Jan 23, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Maybe JCPenney will get a $765 million loan to make pharmaceuticals.

At a party given by a billionaire, Kurt Vonnegut informs Joseph Heller that their host had made more money in a single day than Heller had earned from his novel Catch-22.

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- sidney lanier

- Head Coach

- Posts: 7,254

- And1: 10,494

- Joined: Feb 03, 2012

- Location: where late the sweet birds sang

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

HaroldinGMinor wrote:Maybe JCPenney will get a $765 million loan to make pharmaceuticals.

I doubt it. Unlike Moderna, they have some experience bringing things to market.

"The Bucks in six always. That's for the culture." -- B. Jennings

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Lippo

- Head Coach

- Posts: 6,057

- And1: 980

- Joined: Jun 15, 2006

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Lippo wrote:LINK is booming this year, to the moon link marines...

30x since got in...wooot

And... another 30% in 2 days, no other crypto fiends out there holding this for 3 years?

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- JEIS

- Assistant Coach

- Posts: 4,162

- And1: 2,301

- Joined: Jul 05, 2006

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

hege53190 wrote:Nowak008 wrote:JEIS wrote:Pretty good chance Benzo buys out JC Penney's in the near future. He just pulled out $3 billion worth of his Amazon stock... The other bidder offered 1.75 billion. Could be a nice play.

Good suggestion - I'll roll the dice with you.

I am always in for a bargain. However JC Penny has $2.2 Billion in lender debt. The offers in Bankruptcy court were like $1.8 Billion. Out of the $3Billion that Benzo withdrew I would assume that a significant portion is going to taxes (like 20-25%). JC Penney has 320 million shares of common stock outstanding.

I am just not sure how you make money off of this. I am asking because I am curious.

It doesn't have to make sense... It has to make cents, then dollars. It is likely about to fly.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- JEIS

- Assistant Coach

- Posts: 4,162

- And1: 2,301

- Joined: Jul 05, 2006

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

hege53190

- Head Coach

- Posts: 7,334

- And1: 2,671

- Joined: Nov 29, 2001

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

JEIS wrote:hege53190 wrote:Nowak008 wrote:

Good suggestion - I'll roll the dice with you.

I am always in for a bargain. However JC Penny has $2.2 Billion in lender debt. The offers in Bankruptcy court were like $1.8 Billion. Out of the $3Billion that Benzo withdrew I would assume that a significant portion is going to taxes (like 20-25%). JC Penney has 320 million shares of common stock outstanding.

I am just not sure how you make money off of this. I am asking because I am curious.

It doesn't have to make sense... It has to make cents, then dollars. It is likely about to fly.

I still don't know how it makes money. Amazon isn't buying JC Penny. It is buying the Assets out of Bankruptcy cournt. I believe the only way stockholders make money is if the assets sell for a higher price than the 2.2 Billion that is borrowed against it. The last bid from what I heard was 1.8 Billion. Leaving the a $400 million gap before the 320 Million Shareholders even sniff a dime.

I could be totally wrong on this though.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- HaroldinGMinor

- RealGM

- Posts: 15,922

- And1: 21,286

- Joined: Jan 23, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Hope everyone sold their Kodak shares.

At a party given by a billionaire, Kurt Vonnegut informs Joseph Heller that their host had made more money in a single day than Heller had earned from his novel Catch-22.

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Stannis

- RealGM

- Posts: 19,594

- And1: 13,003

- Joined: Dec 05, 2011

- Location: Game 1, 2025 ECF

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

HaroldinGMinor wrote:Hope everyone sold their Kodak shares.

I don't get why anybody would have bought at 40 a share. Or why anyone would not sell at 40 a share.

Even with that 700m loan, the share price increase made zero sense lol.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- sidney lanier

- Head Coach

- Posts: 7,254

- And1: 10,494

- Joined: Feb 03, 2012

- Location: where late the sweet birds sang

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

hege53190 wrote:JEIS wrote:hege53190 wrote:

I am always in for a bargain. However JC Penny has $2.2 Billion in lender debt. The offers in Bankruptcy court were like $1.8 Billion. Out of the $3Billion that Benzo withdrew I would assume that a significant portion is going to taxes (like 20-25%). JC Penney has 320 million shares of common stock outstanding.

I am just not sure how you make money off of this. I am asking because I am curious.

It doesn't have to make sense... It has to make cents, then dollars. It is likely about to fly.

I still don't know how it makes money. Amazon isn't buying JC Penny. It is buying the Assets out of Bankruptcy cournt. I believe the only way stockholders make money is if the assets sell for a higher price than the 2.2 Billion that is borrowed against it. The last bid from what I heard was 1.8 Billion. Leaving the a $400 million gap before the 320 Million Shareholders even sniff a dime.

I could be totally wrong on this though.

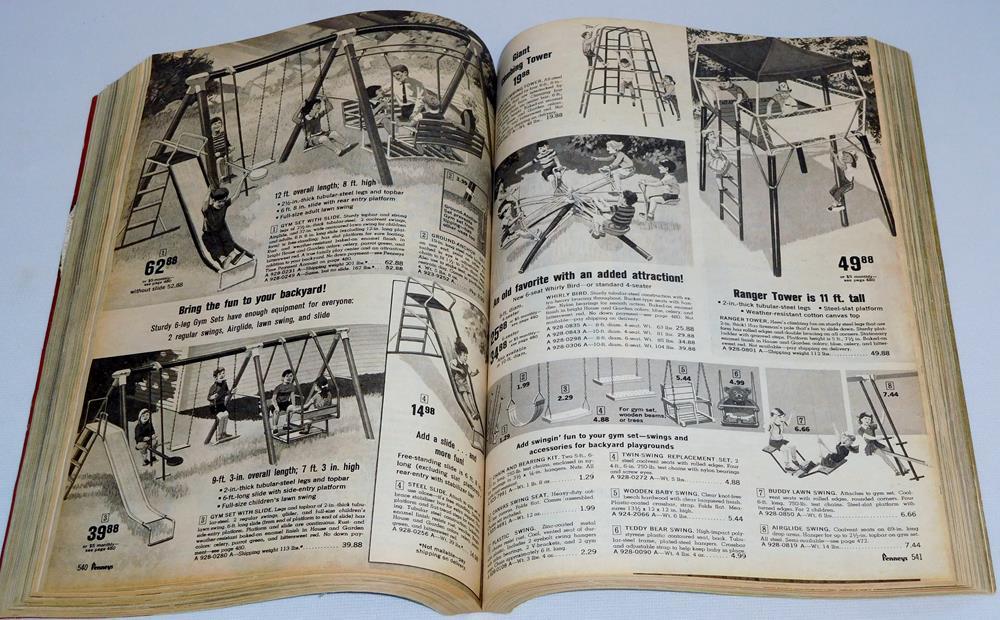

How things come full circle. That big J.C. Penney warehouse on Burleigh and Hwy. 45 used to be because of this...

... and, if Amazon scoops up these distressed properties, it will return to its sell-to-remote-buyers roots.

"The Bucks in six always. That's for the culture." -- B. Jennings

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- step3profit

- Analyst

- Posts: 3,163

- And1: 819

- Joined: Jul 11, 2007

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

sidney lanier wrote:How things come full circle. That big J.C. Penney warehouse on Burleigh and Hwy. 45 used to be because of this...

... and, if Amazon scoops up these distressed properties, it will return to its sell-to-remote-buyers roots.

Not gonna lie, I would buy that Ranger Tower.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- BucksFanSD

- Veteran

- Posts: 2,881

- And1: 1,516

- Joined: Jun 28, 2012

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Fast forward from April and May's discussion on stocks and housing prices.

April/May - Will we re-test stock market lows? Will we go lower than that? It will take X years for this stock market to re-gain what it lost. How far will housing prices fall? How much inventory will hit the market for a discount?

Today - S&P and NASDAQ at record highs. US Housing Prices at record highs.

April/May - Will we re-test stock market lows? Will we go lower than that? It will take X years for this stock market to re-gain what it lost. How far will housing prices fall? How much inventory will hit the market for a discount?

Today - S&P and NASDAQ at record highs. US Housing Prices at record highs.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- HaroldinGMinor

- RealGM

- Posts: 15,922

- And1: 21,286

- Joined: Jan 23, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

I think I'm the only person on the planet that lost money on Zoom.

At a party given by a billionaire, Kurt Vonnegut informs Joseph Heller that their host had made more money in a single day than Heller had earned from his novel Catch-22.

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- machu46

- RealGM

- Posts: 11,066

- And1: 4,396

- Joined: Jun 28, 2012

- Location: DC

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

HaroldinGMinor wrote:I think I'm the only person on the planet that lost money on Zoom.

But...how?

The money I've made on Zoom and Square during this pandemic is absolutely insane lol. I nearly pooped my pants when I saw Zoom's stock today.

trwi7 wrote:**** me deep, Giannis. ****. Me. Deep.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- HaroldinGMinor

- RealGM

- Posts: 15,922

- And1: 21,286

- Joined: Jan 23, 2013

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

machu46 wrote:HaroldinGMinor wrote:I think I'm the only person on the planet that lost money on Zoom.

But...how?

The money I've made on Zoom and Square during this pandemic is absolutely insane lol. I nearly pooped my pants when I saw Zoom's stock today.

I bought it at $154 on a whim. It immediately dove down to $119 and I thought "Man, I literally did zero research on this thing." and I never invest like that so I sold (I got in DraftKings at $20 so I'm doing ok there but obviously wish I had just stuck it out with Zoom). Then I saw a few people whose opinions I respect suggest it was a good short sell candidate. Shows what anyone knows.

At a party given by a billionaire, Kurt Vonnegut informs Joseph Heller that their host had made more money in a single day than Heller had earned from his novel Catch-22.

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Heller responds, “Yes, but I have something he will never have — ENOUGH.”

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- Stannis

- RealGM

- Posts: 19,594

- And1: 13,003

- Joined: Dec 05, 2011

- Location: Game 1, 2025 ECF

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Zoom sent a bunch of other names flying like Docusign, ZScaler, and CrowdStrike.

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

-

Thunder Muscle

- RealGM

- Posts: 15,748

- And1: 1,319

- Joined: Feb 18, 2005

- Location: WI

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Novice question. High level,, my understanding is you are subject to capital gains tax if you buy/sell a stock for profit if held it under year. Is it subject to tax if you sell the stock or sell stock "and" withdraw the money from the brokerage account to bank account?

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

- step3profit

- Analyst

- Posts: 3,163

- And1: 819

- Joined: Jul 11, 2007

-

Re: OT: Investing - Stocks/Mutual Funds/Bonds/Crypto

Thunder Muscle wrote:Novice question. High level,, my understanding is you are subject to capital gains tax if you buy/sell a stock for profit if held it under year. Is it subject to tax if you sell the stock or sell stock "and" withdraw the money from the brokerage account to bank account?

If you sell the stock. You aren't taxed on money-in-hand, you are taxed on profit-on-stock-sale.