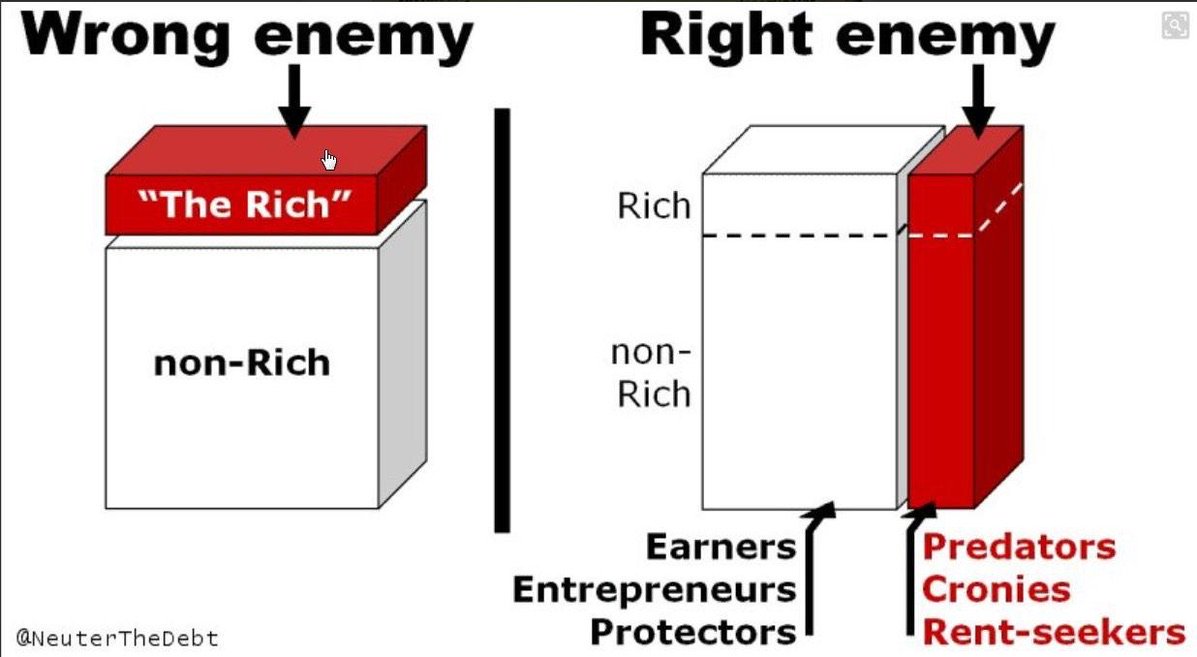

aq_ua wrote:E-Balla wrote:Rasho Brezec wrote:That tweet is a false dichotomy. This is the correct one.

I hope you all earn some money from this.

There's not many rich that aren't rent seekers. Like the whole system of capitalism is built to encourage accumulating wealth without actually bringing value and being an entrepreneur doesn't necessarily change rent seeking being a large part of your earnings.

To take it a step further, there's really very few paths for the non-super-talented to increase wealth without being a rent seeker. How The question is whether rent seeking brings value or not - certainly moving money around has helped increase the size the overall availability of wealth. On the flip side, for the non-rent seekers, how much value does a 9 to 5 job really bring to the world in the broad context of things. Don't want to derail the topic though.

Is a rent seeker another term for landlord?

I did that for years. Ended up costing me a lot, especially in Nassau county which has some ridiculous rules even in an eviction

IE you have to house their crap for a month, even if they’re long gone which my tenants were. Cost me $1300. Just one of the many many many fees that they never tell you about when they say “just be a landlord”

Also, look into the new tax rules on rental property. Used to be that you could move in for two years and now it’s considered your property, so you could sell afterwards and rollover the taxes on the sale as long as you bought another house. Now it’s a proportion.

Not trying to discourage anyone from doing it, just know everything about it