Gant wrote:Captain_Caveman wrote:Curmudgeon wrote:

It's a significant advantge. First, NBA teams play 41 home games. So (in the case of a player on a Florida team) 50% of current earned income is apportioned to Florida. Some is apportioned to other states with no state income tax, e.g. Texas. Second, Hayward almost certainly has income from a portfolio of investments made from the money he earned in prior years (unless his agent is a complete boob). In Massachusetts, cap gains from those investments are taxed at !2%, which is tacked on to the federal rate. (Short-term cap gains are taxed by the feds as ordinary income. Long-term gains are taxed at 20% for taxpayers in the highest brackets.) Third, any dividends from stock or other investments are not taxed in Florida. Neither are royalties or any other form of income characterized as "ordinary" by the IRS. Fourth, depending on where he lives, local property taxes are much lower in Florida. Municipal services are cheaper (e.g. no snow removal, lower labor costs) and per pupil expenditures in the schools are lower.

Of course there are tradeoffs. If he comes to Boston and lives in Weston, Wellesley or one of the other toney Western suburbs, he can send his kids to the public schools, which are outstanding. If he lives in the Miami area, he probably has to put them in private schools if he wants the best education for them. Also, states with no income tax tend to have regressive state sales taxes. He will pay no sales tax in Massachusetts on food purchased in a grocery store (with some exceptions) although he will pay 6.25% on restaurant meals. In Florida the tax is 6% on everything.

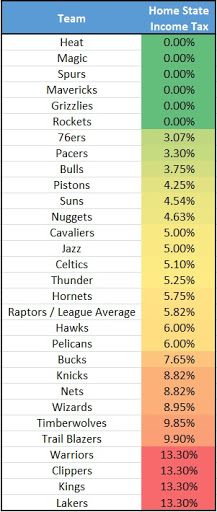

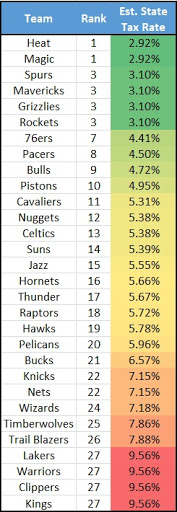

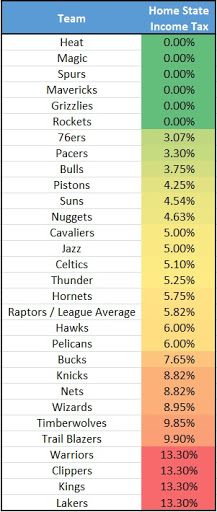

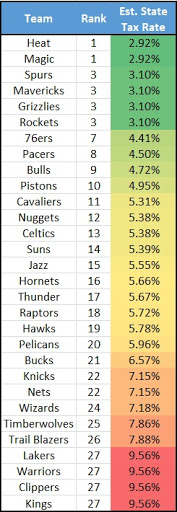

Walking it back a bit to state income tax, still overstated as I understand it. First chart is state tax rates by team. Second chart is adjusted for the schedule of where each team plays its games. On top of that, there are tax credits on the "out-of-state" state taxes you pay in your road games in "tax states" that are not available to players in "no tax states". This brings the state income tax difference down to 1% or so between teams like Miami and Boston. May be a more pronounced advantage over teams like the Knicks or Kings, but not so much us.

As to the higher cost of living and capital gains and the rest, yes, a similar advantage exists, but also easy to overstate. As you said, there are tradeoffs, but there are also loopholes and workarounds and tax credits similar to what I mentioned above.

All told, unless he is the most successful investor alive, we are talking a difference of a few million dollars, to a guy who will probably make $300m+ in his career from salary and endorsements.

Taking a look at that chart above, state tax rate has nothing to do with attracting or losing free agents. Historically, some of the most attractive destinations are found with the highest rates.

It might or might not have mattered for an individual player here or there, but over all, it hasn't mattered at all. Look at the Lakers and Warriors tax rate. Orlando is at 0%, and lost Shaq to high tax California. Durant also went to California. LeBron went to a lower tax state, and then back to a higher one. Last year Horford chose Massachusetts over Texas.

There are some things that get left out when discussing the state tax stuff. From the CBA FAQ:

78. Are teams really competing on a level playing field? Since the tax rate is different in the different states and Canada, don't the teams in a more "tax friendly" state have an advantage over the other teams?

Yes they do. For example, an offer from Orlando will provide a higher net income than the same offer from Los Angeles, because the player will play at least half his games in a state with no state income tax. But the advantage is not quite as large as you might expect, because most jurisdictions with NBA teams require visiting athletes to pay state income taxes (often called a "jock tax") for each "duty day" they spend there. There is not a universal definition for a duty day, but it is generally considered to be any day the player spends in a particular jurisdiction, including for preseason, regular season and postseason games. For example, if there are 170 duty days in a season and a player plays five of those duty days in a state with a jock tax, then the player will pay state income taxes in that state based on 5/170 of his income.1

Currently:

Florida (Heat and Magic), Tennessee (Grizzlies) and Texas (Mavericks, Rockets and Spurs) have no state income tax.

Florida (Heat and Magic), Ontario (Raptors), Tennessee (Grizzlies), Texas (Mavericks, Rockets and Spurs) and Washington D.C. (Wizards) do not make visiting athletes pay a jock tax.

Illinois (Bulls) does not make visiting athletes pay a jock tax if they come from jurisdictions without a jock tax. However, Illinois does not credit its residents for jock taxes paid out of state, so Bulls players can be double-taxed for some road games.

The league also has regulations to help neutralize the tax disadvantage of Canadian teams, and there is language in the CBA to help protect players' benefits from any adverse effects caused by changes in Canadian legislation or tax laws.

Incidentally, players are always paid in U.S. dollars, even if their team is located in Canada.

1 Tax laws are nuanced and complicated, and vary considerably from state to state. For this reason it is very difficult to determine a player's net income based on his salary and the state in which his team plays. For example, California does not exempt players from taxes on income earned while playing in other states. Instead it nets jock taxes paid in other states against California taxes, so a player based in California may owe taxes to two states for the same road games.

The interesting thing too is that most players do claim residency in the state they play. Each state has tax laws around resident/vs working in state.

Overall, I would make too much of the lack of a state tax. If you talk to enough players and agents here is what matters:

1. Money

2. Situation (the gap between 2 and 1 closes as players get older)

3. Family influence

4. Weather

People laugh about the weather one, but there is a reason the vast majority of NBA players live in Los Angeles, Las Vegas, Florida and Texas in the offseason.